The daily price action resembles a Doji like candle carrying higher highlow - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

• The Nifty started the week with a positive gap 18117-18211 and underwent profit booking from 18250 mark. However, buying demand in the fag end of the session helped index to settle above 18200 mark. The daily price action resembles a Doji like candle carrying higher highlow. The formation of lower shadow signifies elevated buying demand

• The index has resumed primary up trend after a couple of days breather. We reiterate our positive stance and expect the Nifty to challenge the all-time high of 18600 in coming couple of weeks. The rejuvenation of upward momentum in midcap and small cap segment signifies broader market participation that augurs well for durability of ongoing up move. Thus, dips should be used as incremental buying opportunity. Our positive stance on the market is anchored upon following observations: a) breakout from 12 month’s falling trend line confirms conclusion of corrective bias, in turn, suggesting resumption of the primary up trend b) Over the past two decades, Q4 returns for the Nifty have been positive (average 11% and minimum 5%) on 15 out of 21 occasions (70%). History favours buying dips c) India VIX, which gauges market volatility, has recorded five month’s range breakdown and is trading below 16, indicating low risk perception among market participants d) Indian equities continued to relatively outperform their global peers, showing inherent strength e) US indices oversold: Percentage of stocks above 200-dma for S&P500 and Nasdaq has approached bearish extreme of 15 and 12. Over two decades, readings below 15 and 12 have led to meaningful durable bottoms. We therefore expect US indices to pose technical pull backs from oversold readings f) US Dollar/INR pair retreated from upper band of long term rising trend line placed at 83.30 while Dollar index has faced stiff resistance from decade long resistance trend line placed around 115

• Structurally, The formation of higher peak and trough support by across sector participation makes us confident to revise support base upward at 17800 as it is 38.2% retracement of past three week’s rally 17100- 18255

• The Nifty midcap and small cap indices resolved out of five weeks base formation above 52 weeks EMA. We expect, broader market indices to accelerate upward momentum and witness catch up activity against the Nifty

• In the coming session, index is likely to witness gap up opening tracking buoyant global cues. We expect index to maintain higher high-low formation and endure its positive momentum. Hence, use dips to create intraday long positions in the range 18285-18314 for target of 18404.

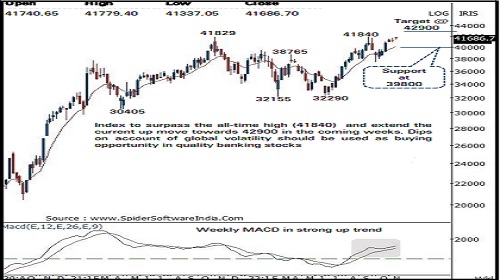

Nifty Bank

• The daily price action formed a Doji candle with a long lower shadow signaling support at lower levels . The index maintained higher high -low highlighting continuation of the positive momentum

• Going forward, we reiterate our positive stance as we expect the index to surpass the all -time high (41840 ) and extend the current up move towards 42900 levels in the coming weeks being the 123 . 6 % external retracement of the recent breather (41840 - 37386 ) . Dips on account of global volatility should not be constructed as negative instead should be used as a buying opportunity

• Nifty PSU banking stocks are expected to continue to outperform . The PSU bank index has recently posted a resolute breakout above CY21 highs and past five years down trend line indicating strong structural uptrend . While large caps have seen strong traction, we expect smaller PSU banks to catch -up and witness strong upward momentum .

• Structurally, in the Bank Nifty rallies are getting faster and stronger while corrections are shallow, underpinning inherent strength . It has recently generated a faster retracement on higher degree as eight month’s decline (41829 -32990 ) was completely retraced in just two and half months highlighting robust price structure

• The Bank Nifty has support at 39800 mark being the confluence of the (a) 38 . 2 % retracement of the last four weeks up move (37387 -41779 ) placed at 39880 (b) the 10 weeks EMA currently placed at 39930 levels

• In the coming session, index is likely to open gap up amid firm global cues . We expect the index to trade with positive bias while maintaining higher high -low . Hence, after a positive opening use intraday dips towards 41780 -41860 for creating long position for the target of 42130 with a stoploss at 41670

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">