The Nifty Bank index continued with its downtrend for the third consecutive session - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE (Nifty): 14310

Technical Outlook

* Equity benchmarks tumbled as the market sentiments were spooked by surging Covid-19 cases and fears of a lockdown. The Nifty ended Monday's session at 14310, down 524 points or 3.5%. Market breadth turned negative with A/D ratio of 1:7. Sectorally, all major indices ended in the red weighed by financials, auto and metal.

* The Nifty started the week with a gap down (14652-14834) opening below 50 days EMA (14645) and traded southward throughout the session as intraday pullbacks were short lived. As a result, the index formed a sizable bear candle, indicating corrective bias and extended profit booking

* The across sector sell off hauled the index to the lower band of consolidation of past four weeks, placed at March low of 14260. Going ahead, follow through weakness (on a closing basis) below Monday’s low of 14250 would lead to extended correction towards key support threshold of 13900-13800 range. Else there would be a pullback attempt amid stock specific action ahead of Q4FY21 result season. Sectors like IT, pharma are well poised and likely to outperform while, for a meaningful pullback to materialise, BFSI space (~40% weight) needs to stabilise

* The broader market indices have undergone profit booking after approaching their 52 weeks highs. Key point to highlight since March 2020 is that, Nifty midcap and small cap indices have maintained the rhythm of not correcting for more than average 9- 10% while sustaining above their 50 days EMA, indicating robust price structure.

* Currently, the 7% correction in the past couple of days dragged both indices in the vicinity of their 50 day’s EMA, indicating possibility of couple of percentage correction from hereon cannot be ruled out. However, such a correction should be capitalised on to accumulate quality stocks, as we expect broader market indices to maintain aforementioned rhythm of not correcting for more than 9-10%

* Strong support zone is present at 13900-13800 range, as it is confluence of:

* a) since March 2020, the intermediate corrections in the Nifty has been to the tune of 9- 10%. In current scenario 10% correction will complete around 13900

* b) 80% retracement of the February rally (13596-15432), at 13963 In the coming session, the index is likely to open on a flat note and trade with a corrective bias as intermediate pullbacks have been short lived. Hence, use intraday pullback towards 14455-14480 to create short position for the target of 14365

NSE Nifty Daily Candlestick Chart

Nifty Bank: 30792

Technical Outlook

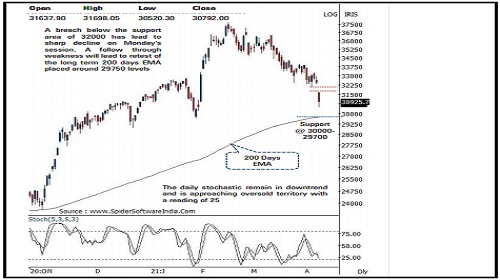

* The Nifty Bank index continued with its downtrend for the third consecutive session as it witnessed sharp decline on Monday’s session to close lower by 5 % . The decline was broad based as all the 12 index constituents closed in the red . The Nifty Bank closed the session at 30792 down by 1656 points or 5 . 1 %

* The daily price action formed a sizable bear candle with a lower high -low and a bearish gap above its head (32330 -31700 ) signalling continuation of the corrective bias . The index on Monday’s session breached its crucial support area of 32000 and witnessed sharp decline to close below 31000 levels .

* Goining ahead, follow through weakness (on a closing basis) below Monday’s low of 30520 would lead to extended correction towards key support threshold of 30000 -29700 range, else a pullback attempt amid stock specific action ahead of Q 4FY21 result season

* Key observation is that the index in the current bull market that is since March 2020 , has seen two major correction during April and September 2020 . The average of the two correction comes around 21 % . In the current scenario the index has already corrected by 19 % from the all time -high (37708 ) . We expect the index to maintain the same rhythm and hold onto the major support area of 29700 -30000 which also confluence with the 200 days EMA placed around 29750 levels and the previous major low of January 2021 , prior to the union budget is placed around 29687 levels

* W e advise Investor should adopt strategy of utilising the current declines to accumulate quality banking stocks from medium term prospective .

* The last eight weeks corrective decline has lead to the weekly stochastic placed near the oversold territory with a reading of 16 . However, the index require to start forming higher high -low in the daily chart on a sustained basis and close above the immediate hurdle of 32000 to signal a pause in the current corrective trend .

* In the coming session, the index is likely to open on a flat note . Volatility is likely to remain high and the index is expected to trade with corrective bias as forming lower high -low and as intermediate pullbacks have been short lived . Hence use pullback towards 31050 -31110 for creating short position for the target of 30810 , maintain a stoploss of 31220

Nifty Bank Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Nifty retained its close above its 5 DEMA support of 25190 despite of the weak start due to ...