Stocks step back, oil bounces as peace talks stall

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

SINGAPORE - Stockmarkets took a breather on Friday after several days of sizeable gains, while commodities were set on edge by the lack of progress in Russia-Ukraine peace negotiations.

Oil rose sharply and back over $100 overnight and Brent crude futures were up another 2% to $108.73 in early trade. [O/R] Commodity exporters' currencies rose with it.

S&P 500 futures fell 0.6% in Asia. MSCI's broadest index of Asia-Pacific shares outside Japan eased 0.6% in early trade, but were headed for a 3% weekly gain. Japan's Nikkei rose 0.2%. [.T]

"It's very difficult to get any confidence that you're going to be able to reliably source commodities out of Russia or Ukraine," said Tobin Gorey, a commodities strategist at Commonwealth Bank of Australia in Sydney.

"You're going to be looking elsewhere and that just tends to get priced up."

The war in Ukraine has settled into a grinding pattern of siege.

Sentiment had been supported by Russia appearing to make a dollar bond coupon payment - avoiding default - and previous comments from Moscow about a deal with Ukraine being close.

However, after a fourth straight day of talks between Russian and Ukrainian negotiators, messaging from both sides suggested agreement remained some way off.

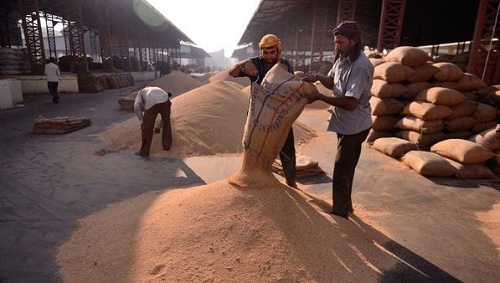

Wheat and corn futures, which are sensitive to Black Sea supply disruptions, bounced sharply overnight. [GRA/]

The Bank of England also raised interest rates on Thursday, as expected, but turned dovish in its outlook amid worries that soaring commodities will hurt growth and demand.

Gilts rallied after the decision and sterling briefly fell as traders turned less sure about future hikes.

The Treasury market is likewise sounding a warning on the outlook, with the yield curve flattening and flirting with inversion as investors think rate hikes that the Federal Reserve began on Wednesday will end up hurting growth. [US/]

Benchmark 10-year yields were steady at 2.1813%.

CHINA STEADIES

Wall Street indexes rose overnight to close out their biggest three-session percentage gains since November 2020. The S&P 500 and Dow Jones each rose 1.2% and the Nasdaq 1.3%. [.N]

China markets on Friday eased into the end of one of the wildest weeks in decades.

Hong Kong's Hang Seng followed its worst session in more than six years with its biggest two-day rally since 1998 after China's top financial policymaker promised policy easing and a gentler approach to market-sensitive reform in future.

Investors now await actions to follow his words and on Friday the Hang Seng opened 1% lower while the mainland blue-chip CSI300 was down 0.5% in early trade. [.HK]

In currency markets, the U.S. dollar was eying its first weekly loss in six weeks as hope for an end to the war has lifted the euro and as commodity exporters' currencies have benefited from higher prices.

The euro was steady at $1.1093 and up 1.7% for the week. The Australian dollar, which caught an additional boost from stellar employment data on Thursday, hit an almost two-week high of $0.7394. [AUD/]

The yen is on course for a second consecutive weekly loss of more than 1% and last traded at 118.73 to the dollar.

The Bank of Japan concludes a two-day meeting later on Friday and, unlike the rest of the world, is expected to keep policy ultra-easy for some time yet.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">