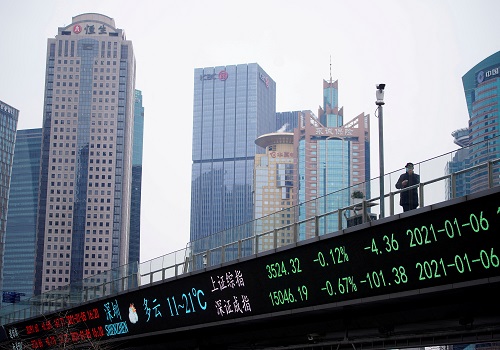

Shares turn mixed, 2-year Treasury yields near 2.5%

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

SYDNEY - World share markets were mixed on Monday amid talk of yet more sanctions against Russia over its invasion of Ukraine, while bonds continued to spell the risk of a hard landing for the U.S. economy as short-term yields hit three-year highs.

A holiday on China made for sluggish trading, and MSCI's broadest index of Asia-Pacific shares outside Japan inched up 0.3%.

Japan's Nikkei dipped 0.1%, while S&P 500 stock futures eased 0.1% and Nasdaq futures 0.2%. EUROSTOXX 50 futures were flat and FTSE futures added 0.4%.

While Russia-Ukraine peace talks dragged on, reports of Russian atrocities led Germany to say the West would agree to impose more sanctions in coming days.

Germany's defence minister also said the European Union must discuss banning imports of Russian gas, a step that would likely send prices yet higher while forcing some sort of energy rationing in Europe.

Data out last week showed inflation in the EU had already surged to a record high, piling pressure on the European Central Bank to rein in runaway prices even as growth slows sharply.

"It really looks like it is time for the ECB to act," warned analysts at ANZ in a note. "While the ECB will be cautious about raising rates, it certainly looks like it should act sooner to abolish its QE programme."

The U.S. Federal Reserve has already hiked and is seen doing a lot more after Friday's solid March payrolls report. A number of Fed officials are due to speak at public events this week, with the prospect of sending more hawkish signals, and minutes of the last policy meeting are due on Wednesday.

"We now expect the Fed to hike by 50bps in May, June, and July, before dialling the pace back slightly by delivering 25bps hikes at the September, November and December," said Kevin Cummins chief U.S. economist at NatWest Markets.

"This will bring the funds rate into restrictive territory sooner, with 2.50-2.75% by year-end 2022."

Investors reacted by hammering short-dated Treasuries and further inverting the yield curve as the market priced in the risk all this tightening would ultimately lead to recession.

On Monday, two-year yields were up at three-year highs of 2.49% and well above the 10-year at 2.410%.

The jump in yields has underpinned the U.S. dollar, particularly against the yen given the Bank of Japan acted repeatedly last week to keep its bond yields near zero.

The dollar was trading firm at 122.60 yen and not far from its recent seven-year peak of 125.10. The euro drifted to $1.1041 and could fall further should the EU actually act to stop gas flows from Russia, which calls its actions in Ukraine a "special operation".

The dollar index was last at 98.617, having recently bounced around between 97.681 and 99.377.

The rise in bond yields globally has been a drag on gold, which pays no return, and the metal was stuck at $1,920 an ounce. [GOL/]

Meanwhile oil prices fell after the United Arab Emirates and the Iran-aligned Houthi group welcomed a truce that would halt military operations on the Saudi-Yemeni border, alleviating some concerns about potential supply issues. [O/R]

Oil slid 13% last week - the biggest weekly fall in two years - after U.S. President Joe Biden announced the largest-ever U.S. oil reserves release.

Brent was last quoted 47 cents lower at $103.92, while U.S. crude lost 33 cents to $98.94. [O/R]

.jpg)