Stock Picks For the Year 2022 - Angel One Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The Indian economy had staged a V-shaped recovery post the second Covid wave in Q1FY2022 due to the quick reopening of the economy. Moreover strong festive demand also helped the recovery process. The manufacturing PMI for November hit a 10-month high of 56.3 while services PMI at 58.1 for November point to a continued solid pace of expansion in the services sector. While we expect the economic recovery to continue, high global inflation and aggressive tightening by the US Fed will be key issues in CY2022, though the impact of Omicron variant should be transient and limited to 1QCY2022. We are positive on banking and Consumer-facing sectors as we do not see any long lasting impact from Omicron and expect strong rebound in earnings for the sectors in FY2023. We also remain positive on Chemicals and IT sector given high medium-term growth visibility for both the sectors.

High-frequency indicators point to continued economic recovery

High-frequency indicators like PMI numbers, GST collection, and E-way bill generation, etc. continue to point to a quicker than expected recovery in the economy. Strong festive demand also contributed to the recovery process. The manufacturing PMI for November hit a 10-month high of 56.3 and points to a continued strong rebound in the manufacturing sector. Services PMI at 58.1 for November also point to a continued solid pace of expansion post reading of 58.4 in October. GST collection for Nov’21 was up by 25% Yoy to ₹1.31 lakh Cr. and corroborates the economic recovery.

Accelerated tapering and Omicron strain contributing to uncertainties

Markets turned volatile from the second half of November due to the emergence of Omicron strain of Coronavirus in South Africa (RSA) and accelerated tapering timelines by the US Fed. In the Dec’21 FOMC meeting, the US Fed has accelerated the timeline for tapering to Mar’22 from Jun’22 while the dot plots indicate at least three rate hikes by the end of 2022. Accelerated tapering by the US Fed and the rapid spread of Omicron globally has led to selloff by FII’s thus leading to increased volatility in the markets.

High vaccination coverage should limit fallout from any potential third wave

India’s vaccination coverage has increased significantly over the past few months with over 60%/41% of the total population being partially/fully vaccinated. Moreover, anecdotal evidence suggests that though the Omicron strain is highly contagious it doesn’t cause serious illness like the Delta variant. Increased vaccination coverage and low severity should help in limiting the fallout from any potential third wave due to the new Omicron strain.

Banking, Consumer-facing sectors to do well along with Chemicals & IT

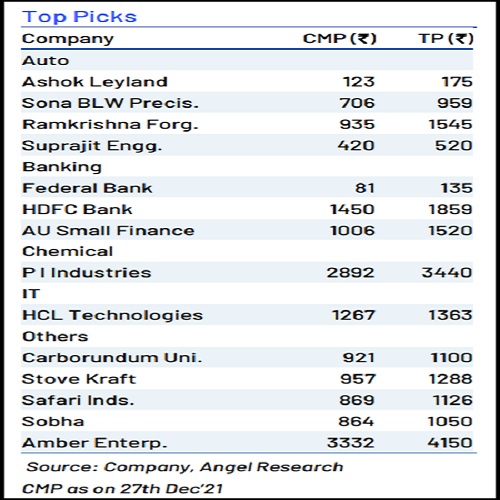

Given the aggressive tightening by the US Fed, there will be a slowdown in FII flows next year though domestic flows should remain robust and make up for any shortfall in FII flow. From a sector perspective, we are positive on Banking, and consumer-facing sectors given expectations of strong earnings growth in FY2023E. We also remain positive on Chemicals and IT sector given high mediumterm growth visibility for both the sectors.

Indian Economy has bounced back strongly post the second wave

Indian economy witnessed good momentum in Q2-Q3 FY22 in anticipation of demand recovery as the festive season approached. For the second straight month in Dec’21, gross GST collection crossed ₹1.30 lakh crore and was at second highest levels ever, second only to April 2021 which gets influenced due to year-end and requirement for quarterly filings. E-way Bills generated too showed strong trends before cooling off in November post the peak of the festive season. The data for December till-date is encouraging, with numbers improving on a weekly average basis against November 2021 indicating a pickup in economic activity.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One