Rupee future maturing on May 27 depreciated marginally by 0.01% amid strong dollar - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

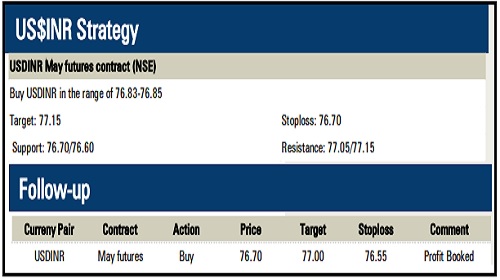

Rupee Outlook and Strategy

• US dollar continued with its upward trend reaching multiyear highs against major currencies like euro, pound and yen. Dollar climbed on geopolitical tensions and expectation of aggressive monetary tightening by Fed. US GDP data showed economy contracted in Q1 CY2022 as supply disruptions weighed on output but consumer and business spending accelerated signalling economy remains resilient

• Rupee future maturing on May 27 depreciated marginally by 0.01% amid strong dollar. Meanwhile, rise in risk appetite in the domestic market prevented further downside in rupee

• Rupee is expected to depreciated today amid firm dollar and surge in crude oil prices. Further, investors anticipate that GDP report from US is unlikely to change Fed plans to raise interest rates rapidly this year. Additionally, escalating geopolitical tensions and persistent FII outflows will hurt market sentiments. Moreover, traders will remain vigilant ahead of major economic data from Europe and US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">