USDINR June futures formed doji candlestick pattern suggested indecisiveness - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

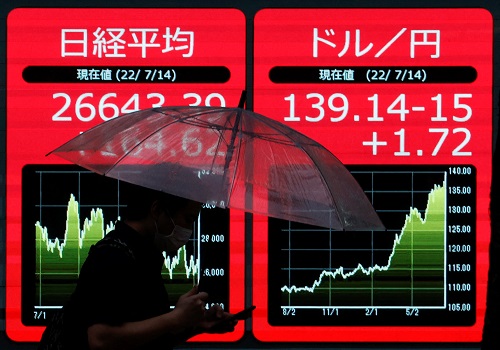

Dollar climbs on Hawkish Fed

Rupee expected to open with dip cuts following other Asian currencies. Most of emergingmarket currencies tracked by Bloomberg fell after the Federal Reserve moved up its projected time frame for interest rate increases, which boosted the dollar. A dollar index had its biggest jump in a year.

The forward markets indicating USDINR to open 38 paise higher from yesterday’s close. USDINR June futures at domestic bourses could open around 73.80 odd levels. Technically, the pair is turned bullish amid higher top higher bottom and placed well above short term moving averages. It has resistance around 74.05 and support at 73.

On Wednesday, rupee fell for the seventh day in row, longest losing streak since August 2018 following stronger dollar, higher crude oil and risk-off sentiments. Spot USDINR closed at 73.33 with gain of a paise.

Federal Reserve held the target range for its benchmark policy rate unchanged at zero to 0.25%- where it’s been since March 2020. The dot plot show two rate hikes by the end of 2023. Officials signaled that the pace of the U.S. economic recovery from the pandemic is bringing forward expectations for how quickly they will reduce policy support. Estimates for inflation for the next three years were upgraded.

USD/JPY touched its highest level since April 1 on Thursday driven by safe haven demand. The dollar hit the highest level in more than a month and Treasury yields jumped after Federal Reserve policy.

Historically, we have seen when the Fed communicates tapering and tightening in one message, and the economy is forecasted to be strong, real yields jump and those can transmit stronger dollar. Things that happens back in 2014, when the Fed's dot plot last surprised to the upside by 50 to 75 basis points

USDINR

USDINR June futures formed doji candlestick pattern suggested indecisiveness. The much awaited event of FOMC done and dollar appreciates against major EM currencies, USDINR is expected to open higher and continue towards 74 odd levels.

The pair started forming higher highs and lows along with stronger oscillators indicating continuation of rally.

USDINR June futures has support at 73.24 and resistance at 73.80 and 74.05, the 50% Fibonacci retracement level adjoining recent high 75.50 and low of 72.60.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

Rupee To Recover On Better Than Expected Economic Data - HDFC Securities

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">