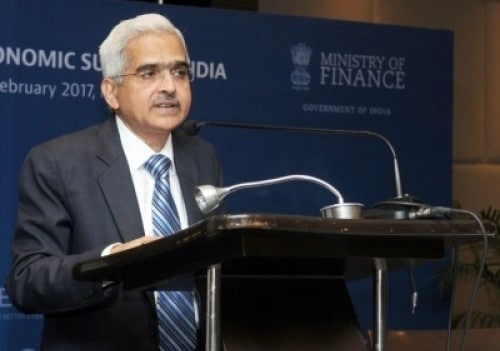

Recent trade agreements, geopolitical conditions open up potential market opportunities for India: Governor Shaktikanta Das

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Reserve Bank Governor Shaktikanta Das has said recent trade agreements and geopolitical conditions open up potential market opportunities for India. Observing that India’s external sector has remained resilient amidst formidable global headwinds, he said provisional data suggest that merchandise exports remained strong in April 2022 and services exports reached a new high in March 2022. He said ‘Potential market opportunities have opened up due to geopolitical conditions and the recent trade agreements. Strong revenue guidance by major information technology (IT) companies also bodes well for the overall external sector outlook in 2022-23’.

He noted that the worsening of terms of trade, driven by high commodity prices could have implications for the current account deficit in 2022-23, but it is expected to be comfortably financed. He said ‘Net foreign direct investment flows have remained robust, despite some recent moderation. Long term flows such as external commercial borrowings also remain stable. India’s foreign exchange reserves are sizeable with net forward assets providing a strong back-up. The external debt to GDP ratio remains low at 20 per cent’. With regard to liquidity, Das assured that the RBI will ensure adequate liquidity in the system to meet the productive requirements of the economy in support of credit offtake and growth.

Quoting from April policy, he said several liquidity management measures were taken in alignment with the shift in the monetary policy stance, including restoration of a symmetric LAF corridor around the policy repo rate and the introduction of the standing deposit facility (SDF). He said these measures operationalise the primacy accorded to maintaining price stability, while keeping in mind the objective of growth. Monetary policy has to engender an environment in which inflation persistence is broken and inflation expectations are re-anchored. He added headroom for this reordering of priorities is becoming available with the receding of the pandemic and the steady broad basing of growth as economic activity regains and surpasses pre-pandemic levels.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings