RBI Monetary Policy : 50bps hike – Global new normal for rate hikes Says Mr. Gurvinder Singh Wasan, JM Financial Asset Management

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

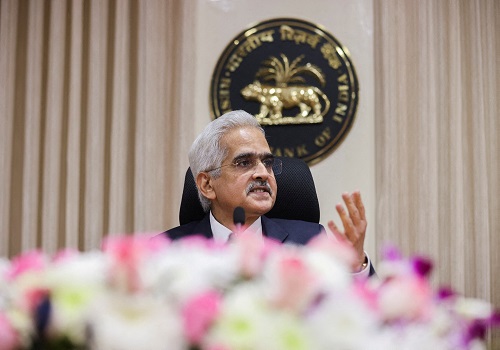

Quote on RBI Monetary Policy By Gurvinder Singh Wasan Senior Fund Manager and Credit Analyst - Fixed Income, JM Financial Asset Management Ltd

The tone of the policy was more hawkish than expected. RBI once again hiked repo rate by 50bps to 5.4% leaving CRR unchanged. Inflation for FY '23 forecasted remains unchanged at 6.70% considering some softening in global food & commodity prices versus the hanging sword of geopolitical risks, transmission of input cost pressures to selling price, etc. RBI retained its GDP forecast at 7.20% for FY '23 citing buoyancy in domestic demand cramped by global risks. RBI further firmed its stance of withdrawal of accommodation till liquidity conditions normalise. RBI stated that when warranted it will conduct two way fine tuning operations (VRR/VRRR) depending on evolving liquidity conditions.

Yields shot up by 12-15 bps across the curve as market participants were divided equally between 35 / 50 bps. We expect rate hikes to continue in FY '23 with yields in general having further upward bias."

Above views are of the author and not of the website kindly read disclaimer

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">