Pre Budget - Technical Outlook : The index has seen a strong rally in the month of January By Axis Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

Trend – The index has seen a strong rally in the month of January registering a new all time high of 14753 levels and closed at 14372. Since March 20, the index surged almost 96% in past ten months making it one of the strongest gains in recent times.

Pattern – Since past two consecutive weeks index continue to form “Spinning Top” candlestick pattern which signals a short term pause in the recent uptrend or traders indecision at current juncture. However index manage to hold and sustain above its ten months Up-Sloping Trendline indicating trend is still intact and any pullback (if any) should be used as a buying opportunity. Going forward Major support is at 14000-13700 levels .

Momentum – On the weekly and monthly chart, the RSI has entered the overbought territory which saying that the momentum is very strong as of now. Good bullish momentum build-up was seen across all the sectors

Direction – The index is expected to trade in positive territory until it breaks 13100 on the downside.

Our take – Nifty has closed at all time high indicating strong and sustained up trend across all the time frames. Though our bias still remains positive, we observed some early signs of profit booking in this overstretched rally, hence traders are advised to wait and watch for short term corrections to create fresh longs. As the Union Budget is near, we can expect good volatility into various stocks which can trigger violent moves on either sides. From current levels, the short to medium term trend still remains intact and the bulls to continue their bullish command into the markets towards 14800-15300 levels. On the downside an immediate support is placed around 14000 levels however any violation of this support zone on closing basis may cause short term correction towards 48000 levels. Major support zone is around 13700-13100 levels.

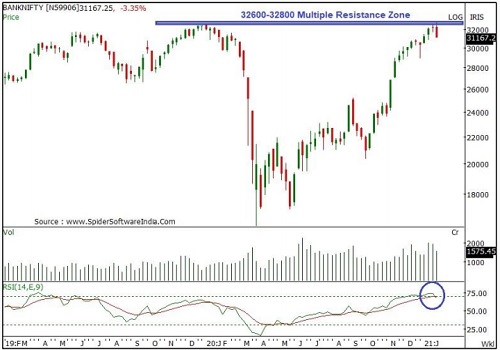

Bank Nifty

Trend – The index has seen strong rally in the month of January registering a new all time high of 32842 levels and closed at 31167. Since March 20, the index surged almost 104 % in past ten months making it one of the strongest gains in recent times.

Pattern – Since past two consecutive weeks index continue to resist around its multiple supply zone of 32600-32800 levels indicating cautious approach at current levels. Major trend still remains intact and any pullback (if any) should be used as a buying opportunity. Going forward Major support is at 30000-28900 levels .

Momentum – On the weekly and monthly chart, the strength indicator RSI and the momentum indicator stochastic both have turned negative from overbought territory which saying that the momentum has slow down along within losing strength.

Direction – The index is expected to trade in positive territory until it breaks 29000 on the downside.

Our take – Bank index has closed at all time high indicating strong and sustained up trend across all the time frames. Though our bias still remains positive, we observed some early signs of profit booking in this overstretched rally, hence traders are advised to wait and watch for short term corrections to create fresh longs. As the Union Budget is near, we can expect good volatility into various stocks which can trigger violent moves on either sides. From current levels, the short to medium term trend still remains intact and the bulls to continue their bullish command into the markets towards 32800-35000 levels. On the downside an immediate support is placed around 30600 levels however any violation of this support zone on closing basis may cause short term correction towards 28900 -28000 levels

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">