Daily Market Commentary 21 August 2021 by Siddhartha Khemka, Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is the Daily Market Commentary 21 August 2021 by Mr. Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services

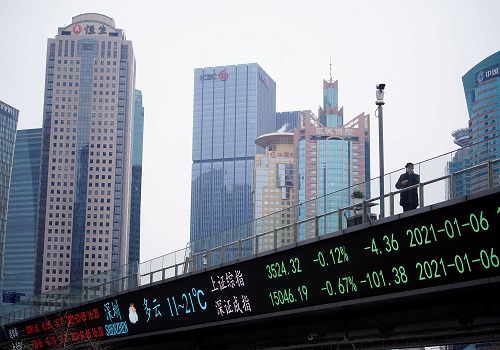

“Equity markets opened gap down in line with its global peers after surging and making new highs over past few sessions. The indices continued to be under selling pressure throughout the session and ended sharply in red. Nifty/Sensex both ended 118/300 points down (-0.7%/-0.5%) at 16451/55329 levels. The broader market too continued to bleed with Nifty midcap 100/ Nifty smallcap 100 down -2% each. Except for FMCG (+2.3%) and Consumption (0.8%), all other sectors ended in red. Metal witnessed highest sell off – down -6.4%, followed by Media, Realty and PSU bank each down more than 3%. While Pharma, Auto, Financial Services, Private Bank, Oil&Gas and consumer durables were down in the range of 1-2%. The volatility index, India VIX spiked 8.6% higher at 14.02evels.

Global markets continue to be under selling pressure as investors fret over signs of U.S. Federal Reserve considering reducing stimulus this year while new lockdowns in countries facing surging cases of the COVID-19 Delta variant dampened the outlook. Thus U.S. dollar jumped to a nine-month high while oil prices continue to be under pressure. Further slowing Chinese growth and regulatory intervention along with Afghanistan turmoil continue to spook the market. As per media reports, China's National People's Congress officially passed a law designed to protect online user data privacy, which is expected to add more compliance requirements for companies in the country.

Mirroring the global markets, domestic equity ended its winning streak of making new highs and ended in negative zone. The indices witnessed sharp selling pressure across the sector except FMCG and consumption. Metal stocks witnessed highest sell-off after a sharp run up - down more than 6%. There was fall in metal stocks on fear of weakening demand due to poor economic data from metals top consumer country i.e. China, rising coronavirus cases globally and the prices of U.S. Base metals like Copper falling over 6% in the last few sessions. On the other hand, FMCG stocks tried to provide some support to the market. On stock specific action, defensive stocks like HUL, Britannia, Asian Paints, Nestle and Bajajfin were top gainers. While Tata Steel, JSW Steel, Hindalco, UPL and Tata Motors were top losers

Technically, Nifty formed a Bullish candle on daily scale but a Bearish candle similar to a Shooting Star on weekly frame. It negated its higher highs - higher lows formation of the last five sessions. Now it has to continue to hold above 16450 to extend the momentum towards 16700 while support is seen at 16200 levels.

Going ahead, global cues will be closely watched for further market direction. With cases of Delta variant rising globally and many countries implementing fresh lockdowns, this is becoming the biggest worry for the markets at the moment along with the nervousness around US Fed taper talks. Further, the economic slowdown and the regulatory clampdown in China too poses a risk. Even Nifty valuations at ~21x 12m forward EPS remain rich and thus consistent delivery on earnings expectations going ahead become crucial. Hence, given the selling pressure in the broader market, the traders should be cautious and adopt stock specific approach while investors can take advantage of this scenario and build their positions from the medium to long term perspective. From the long term perspective, the overall trend of the market remains positive led by the opening up of the economy, improving economic data points and pickup in vaccinations.”

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Morning Market Quote : The ongoing trend of largecaps outperforming mid and smallcaps is lik...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">