Opening Bell: Markets likely to continue previous sessions rally with optimistic start

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

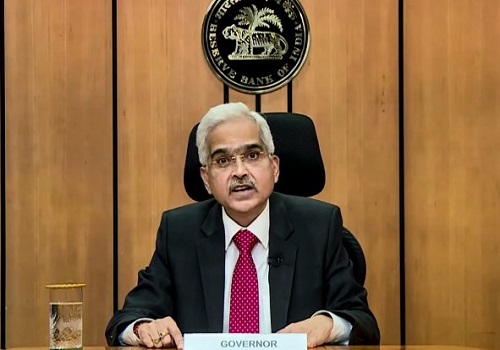

Indian markets settled higher with strong gains on Friday, the last day of fiscal 2022-23, as positive global cues and fresh foreign fund inflows helped underpin sentiment, and contagion fears from the banking crisis continued to ease. Today, markets are likely to continue their previous session’s rally with optimistic start in the holiday-shortened week amid firm global cues. Stock exchanges will remain closed on April 4 for 'Mahavir Jayanti' and on April 7 on account of 'Good Friday'. Sentiments will get a boost as Commerce and Industry Piyush Goyal exuded confidence that India’s merchandise and services exports will cross $2 trillion by 2030 from the current level of $765 billion, as he unveiled a ‘dynamic and responsive’ foreign trade policy. Traders will be getting some encouragement with report that GST collection grew 13 per cent in March to Rs 1.60 lakh crore - the second highest mop-up since the rollout of the indirect tax regime. Some support will come as India’s current account deficit, a key indicator of the country’s external sector, declined to $18.2 billion or 2.2 per cent of the GDP in the December quarter of the current fiscal. Besides, the RBI said in a second consecutive weekly increase, India’s forex reserves rose $5.977 billion to $578.778 billion in the week ended March 24. Meanwhile, the production of eight infrastructure sectors expanded at 6 per cent on an annual basis in February 2023 as all sectors barring crude oil saw positive growth. However, there may be some cautiousness ahead of three-day the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meeting starting from today (April 03) and outcome on April 06. There are expectations that the RBI may go in for 25 basis points hike in benchmark interest rate, probably the last in the current monetary tightening cycle that began in May 2022. Traders may be concerned with the latest public debt management report showing that the government’s total liabilities rose to Rs 150.95 lakh crore in December quarter from Rs 147.19 lakh crore in the three months ended September 2022. Moreover, the data released by the Controller General of Accounts (CGA) showed that the central government’s fiscal deficit touched 82.8 per cent of the full-year target at the end of February. In actual terms, the fiscal deficit or gap between the expenditure and revenue collection during April-February period stood at Rs 14.53 lakh crore. There will be some reaction in coal industry stocks as Union Coal Minister Pralhad Joshi said India has recorded historic growth in its coal output at 982.21 million tonnes (MT) in 2022-23. Autos stocks will be in limelight reacting to their monthly sales numbers.

The US markets ended higher on Friday after an inflation gauge the Fed follows closely rose slightly less than anticipated in February, helping spur optimism the Federal Reserve will hold off on raising interest rates at its next meeting in early May. Asian markets are trading mostly in green on Monday despite a private survey showed China's manufacturing activity stalled in March after expanding in February for the first time in seven months.

Back home, Indian equity benchmarks ended the last trading day of the financial year 2022-23 (FY23) on a firm note, with Sensex and Nifty regaining crucial psychological levels of 58,990 and 17,350, respectively. All sectors ended in green with IT, TECK and Banking being major gainers. Markets made a gap up opening and continuously strengthen throughout the session tracking firm global markets and supportive local cues. Traders took encouragement with Chief Economic Advisor (CEA) V Anantha Nageswaran expressing optimism over India’s economic growth and said that the country’s economy is likely to grow at the rate of 6.5 per cent in the coming decade on the back of the turnaround in financial and investment cycle. Local bourses extended gains in late afternoon deals, as sentiments got a boost with the World Bank stating that India’s potential growth could benefit from accelerated implementation of an already ambitious reform agenda. Some optimism also came with Commerce and Industry Minister Piyush Goyal’s statement that India was in the ‘bright spot’ amid a series of economic challenges faced by many countries. Adding to the optimism, the government came out with Foreign Trade Policy (FTP) 2023 which seeks to boost the country's exports to $2 trillion by 2030 by shifting from incentives to remission and entitlement-based regime. Fresh foreign fund inflows also added to the positive momentum in the equity market. Foreign Portfolio Investors (FPIs) were net buyers on Wednesday as they bought equities worth Rs 1,245.39 crore, according to exchange data. Finally, the BSE Sensex rose 1031.43 points or 1.78% to 58,991.52 and the CNX Nifty was up by 279.05 points or 1.63% to 17,359.75.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Market reversed early gains and closed near the day`s low with modest losses on Wednesday - ...