Nifty: Level of 14500 important support in ongoing consolidation - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: Level of 14500 important support in ongoing consolidation

* The market witnessed a volatile trend this week along with an attempt to overcome the hurdle of 14950-15000. The banking space turned a major laggard for the week. However, despite a loss of 0.20% in the Nifty, broader markets saw significant movement. Midcap and small cap indices gained almost 1.5% and 3.2%, respectively

* Sectorally, action was seen in metal, cement, technology and pharma stocks. They have compensated for losses sewn in banking and financials stocks. Despite a loss of more than 3% in the banking index, the Nifty ended with marginal losses only suggesting significant outperformance from other sectors

* After a long time, the Nifty witnessed above average additions in ATM Straddle of (14800 and 14900 Call & Put) for the coming week. The combined premium for this straddle is near 250 whereas IVs remained subdued. We feel the index would consolidate in coming trading sessions with strong support for the week at 14500 and resistance at 15000

* After significant outperformance from the metal, cement and other non-heavyweights, a round of profit taking cannot be ruled out from current levels. In such a situation, performance can be expected from technology, pharma and FMCG stock in coming days

Bank Nifty: Short covering expected above 33000…

* On a weekly expiry basis, the Nifty has ended almost flat whereas the Bank Nifty closed almost 1100 points lower in the volatile week, which saw the RBI’s Monetary policy. HDFC Bank, along with Axis Bank, continued to remain under pressure whereas supportive action was seen from Kotak Mahindra Bank, which moved above | 1800 levels

* IVs remained muted near the 20% mark. For a couple of sessions the Bank Nifty has been witnessing closure in OI, which had moved to an almost two year high for the April series. This is a positive set-up

* Despite underperformance even after the policy, the Bank Nifty remained firm above 32000. In the past few instances, we saw a reversal happening from lower levels. Due to higher premiums, writing is happening in OTM strike options, suggesting the index could consolidate with a positive bias

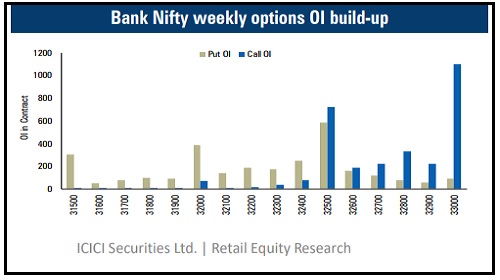

* We feel stock specific action should continue for the week while short covering can pick up pace once the Bank Nifty manages to close above 33000, which has a sizeable Call base

* The current price ratio of the Bank Nifty/Nifty declined marginally to 2.28 levels. We feel no major outperformance will take place in the Bank Nifty during the week. It is most likely to consolidate in a broader range

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Weekly Technical Outlook - In the previous week the BANKING sector strongly outperformed By ...