NBFC-MFI to grow at 28% yoy in FY24: CareEdge Ratings

The NBFC-MFI industry experienced a slowdown in growth in FY21 due to the Covid-19 pandemic. However, growth rebounded in FY23, with the industry reporting a strong growth at 37% Y-o-Y, supported by improved disbursements. This growth momentum is expected to continue, with Care Ratings projecting a healthy loan growth of around 28% yoy for FY24.

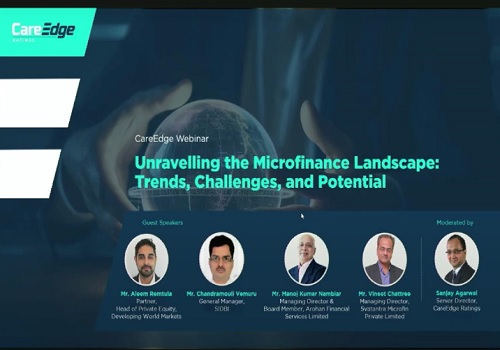

Says Manoj Kumar Nambiar, Managing Director and Board Member, Arohan Financial Services Limited, “The revised RBI regulations will bring in uniformity in income assessment & also 50% FOIR discipline across all types of lenders. This in turn will lead to better credit underwriting, lower delinquencies & provisions and sub 1% credit costs in the long run.”

Further, “Microfinance has reached to only about 30% of the addressable households in India and therefore there remains significant potential for growth over the next few years. For the microfinance sector, it is not about how much you grow, but how you grow. Along with improving the viable reach of MFIs, revised RBI regulatory framework will help in bringing in product differentiation and maturity in the customers regarding their credit profile" said Vineet Chattree, Managing Director, Svatantra Microfin Private Limited

NBFC-MFI has also benefitted from the renewed confidence shown by the investors with the sector raising close to ?3000 crore of primary equity in FY23 as compared to ?1500 crore in FY22 and 1400 crore in FY21. However, Gaurav Dixit, Director, CARE Ratings said that considering the current global outlook, and various macroeconomic factors, ability of the NBFC-MFI industry to consistently raise capital to support their future growth plans will be a key monitorable.

Says Aleem Remtula, Partner, head of Equity, Developing World Markets, “In terms of private equity activity, the NBFC-MFI space has seen a flight to quality and uptick transaction volume, but continues to be a buyers’ market from a valuation perspective. Though the Companies have stronger fundamentals, seller valuation expectations have been moderated in the recent past.”

Gearing profile for NBFC-MFIs remains comfortable at 3.8x as on March 31, 2023 supported by rising internal accruals and continued equity infusion from the investors. Going froward, CARE edge ratings expects gearing to remain rangebound at around 4.1x as on March 31, 2024.

As per Neha Kadiyan, Associate Director, CARE Ratings, - The asset quality profile of the NBFC-MFIs has also improved with the substantial write offs and better collection efficiency supported by an improving macroeconomic environment. Further asset quality is expected to improve with GNPA ratio expected to moderate to around 2% at end FY 2024.

Now, NBFC MFIs have begun to adapt to new technology trends Also, BC arrangement and Co-lending can be seen as an emerging funding avenue, especially for the smaller NBFC MFIs. Says Chandramouli Vemuru, General manager, SIDBI ``Co-lending opportunities remain relatively limited in the micro finance space. BC model is a good start for the smaller NBFC-MFIs.”

Above views are of the author and not of the website kindly read disclaimera