Monetary policy has to be forward looking, says RBI Governor

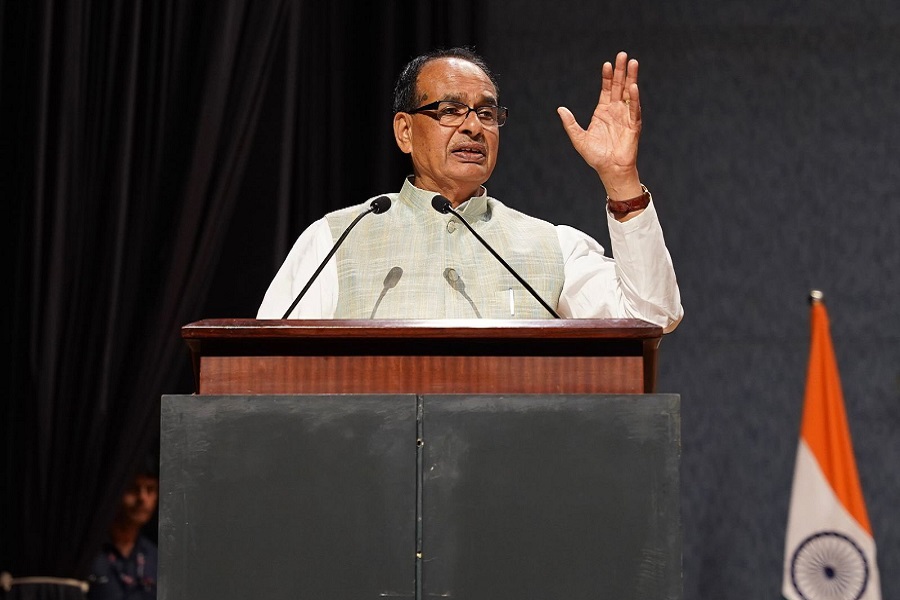

Reserve Bank of India (RBI) Governor Shaktikanta Das on Tuesday said that the monetary policy has to be forward looking, "as a rear view approach can lead to accidents".

Das, who gave the analogy of car driving while delivering the Delhi School of Economics Diamond Jubilee Distinguished lecture, said that the conduct of monetary policy is like driving a car on the road with potential ditches and speed bumps.

"As monetary policy works with long and variable lags, the forecasts of key macroeconomic variables play a vital role in the conduct of monetary policy. It is for this reason that inflation targeting framework is also termed as 'inflation forecast targeting' framework.

"To take a real-life analogy, the conduct of monetary policy is like driving a car on a road with potential ditches and speed bumps. The driver needs to see them ahead and in time to regulate the speed of his car and to negotiate the ditch or speed bump smoothly. If the driver reacts suddenly to a speed bump, he runs the risk of losing control and causing an accident. Therefore, a successful conduct of monetary policy depends critically on credible forecasts of key variables like inflation and growth. In other words, monetary policy has to be forward looking. Rear view mirror can lead to policy errors," he said.

The RBI Governor also said that it is important for the monetary policy committee (MPC) to keep track of price stability and act accordingly. "Further, the MPC remains cautious to ensure second order effects of inflation in the form of generalisation of price hike is not allowed to take hold," Das added.

"It is necessary to watch price stability and act appropriately. We are now firmly focused on 4 per cent target," he said.

Das further noted that RBI planned liquidity management in the post-Covid era in a way not to disrupt price stability.

"Most of our liquidity injection measures were announced for one year or three year periods. This enabled them (market participants) to plan their activities in a manner to return the money to the central bank in one year or three years," he said.

Going by the past experience, the RBI was able to adopt a unique and innovative approach which has enabled RBI to roll back Covid time special meaures which were undertaken, the RBI Governor added.

"Unless you roll them back in time, it will undermine financial stability. That’s one of the reasons why we see finanicial stabililty and banking sector stability in our economy," Das said.

The central bank is watching the call money market rates closely to ensure effective transmission of the policy actions, he added.

_Securities_(600x400).jpg)

.jpg)

.jpg)