Monetary Policy Update – August 2022 By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Balancing act to control inflation, currency fall…

Repo rate………………………………………………….……. Increased to 5.4% CRR…………………………………………………………...Unchanged at 4.5%

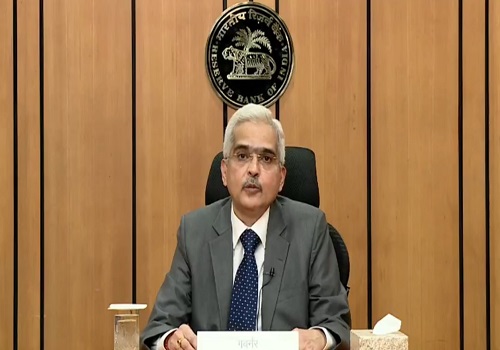

The Reserve Bank of India (RBI) increased its repo rate by 50 bps to 5.4% with immediate effect. Accordingly, the SDF and MSF rate were adjusted to 5.15% and 5.65%, respectively. All members of the MPC have unanimously voted to increase the repo rate. They also voted unanimously to remain focused on withdrawal of accommodation to ensure that inflation remains within the target while supporting growth. This offers some indication on rate hikes continuing.

According to RBI, headline inflation has recently flattened and the supply outlook is improving, helped by some easing of global supply constraints. The MPC noted that inflation is projected to remain above the upper tolerance level of 6% through the first three quarters of FY23, entailing the risk of destabilising inflation expectations and triggering second round effects. The MPC took the view that further calibrated monetary policy action is needed to contain inflationary pressures, pull back headline inflation within the tolerance band closer to the target and keep inflation expectations anchored so as to ensure that growth is sustained. Taking into account all these factors and on the assumption of a normal monsoon in 2022 and average crude oil price, the inflation projection is retained at 6.7% in FY23, with Q2FY23 at 7.1%; Q3FY23 at 6.4%; and Q4FY23 at 5.8%, and risks evenly balanced. CPI inflation for Q1FY24 is projected at 5.0%.

View

Bond market reaction to the 50 bps hike in repo rate was sharply negative with 10-year benchmark G-Sec yield moving up by 10 bps to 7.25% from 7.15%. While the hike was largely on expected lines, the negative reaction was attributable to the positive market positioning going into the policy. The 10-year G-Sec yield had rallied around 9 bps on Thursday with few market participants speculating that RBI may turn dovish in its stance and also on the extent of rate hike. Effectively, that pre-policy exuberance has fizzled out and we are back to Wednesday’s levels on the yield. The focus of RBI seems to be on managing the currency levels as well with rate hike being used as a tool to prevent any sharp depreciation in the rupee.

We believe inflation, in the early part of the next financial year, could be below RBI’s projection of 5.0% given crude oil prices have also now started to moderate from elevated levels. Even assuming medium term inflation at 5.0% and real rate at 1.0%, terminal repo rate is likely at around 6.0%, leaving the future rate hike of 60 bps in the rest of the financial year. Therefore, out of the total 200 bps rate hike in the current rate hike cycle, 140 bps is already behind us and the rest is well discounted by the bond market. Accordingly, yields across the curve are likely to be range bound in near future with volatility emanating from changing market perception and evolving data points. The risk of higher rate hike could only emerge from global factors rather that domestic factors like continuous rate hike by US Fed, currency depreciation pressure due to yield differential and any further supply side disruption due to ongoing geo-political tension.

After almost two years, the debt market outlook has started to look attractive with rate hikes being already done or discounted. Investors may start building their long term fixed income portfolio gradually starting with allocation into medium (two to five years) maturity funds.

RBI development, regulatory measures – Key points

Inclusion of credit information companies (CICs) under the RBI

In order to make the RB-IOS more broad based, it has been decided to bring credit information companies (CICs) also under the ambit of RB-IOS 2021. This will provide a cost free alternate redress mechanism to customers of REs for grievances against CICs. Further, with a view to strengthen the internal grievance redress of the CICs and make it more efficient, it has also been decided to bring CICs under the Internal Ombudsman (IO) framework

Enabling Bharat Bill Payment System (BBPS) to process cross-border inbound bill payments

To facilitate non-resident Indians (NRIs) to undertake utility, education and other bill payments on behalf of their families in India, it is proposed to enable BBPS to accept cross-border inward payments. This will also benefit payment of bills of any biller on boarded on the BBPS platform in an interoperable manner

Expansion in scope of permitted activities of standalone primary dealers

It is proposed to enable SPDs to offer all foreign exchange market-making facilities as currently permitted to Category-I Authorised Dealers, subject to prudential guidelines. This measure would give forex customers a broader spectrum of market-makers in managing their currency risk, thereby adding breadth to the forex market in India. A wider market presence would improve the ability of SPDs to provide support to the primary issuance and secondary market activities in government securities, which would continue to be the major focus of primary dealer activities.

To Read Complete Report & Disclaimer Click Here

For More ICICI Direct Disclaimer http://icicidirect.com/disclaimer.html

SEBI Registration number is INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">