Markets likely to get flat-to-negative start on Thursday

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets ended lower on Wednesday after a two-day rally, pressured by financial, auto and metal stocks. Today, the markets are likely to continue their sluggish performance with flat-to-negative start amid weakness in global markets. Traders will be concerned as India witnessed 276,261 fresh cases, with the new infection count remaining below the 300,000-mark for the fourth consecutive day. The total caseload stands at 25,771,405, Wordometer showed. There will be some cautiousness with ratings agency ICRA’s statement that sequential growth slackening driven by the second wave of Covid-19 in India has emerged as a concern. ICRA also cautioned that bruised sentiment, high healthcare and fuel expenses will limit discretionary purchases in the immediate term. Furthermore, the agency expects a cut-back in spending on contact-intensive services. However, traders may take note of report that the Indian government claimed it has ramped up the production of Remdesivir, an anti-viral drug prescribed for treating moderate-to-critical Covid patients, by 10 times. From 1 million vials per month in April, the Centre claims it will produce 10 million vials this month, as it has increased the number of plants manufacturing Remdesivir from 20 to 60. Meanwhile, the Income Tax department has issued over Rs 24,792 crore refunds to more than 15 lakh taxpayers so far this fiscal. Of this personal income tax refunds worth Rs 7,458 crore has been issued in over 14.98 lakh cases. Corporate tax refunds of Rs 17,334 crore have been issued to 43,661 taxpayers. Banking stocks will be in focus as RBI Governor Shaktikanta Das asked state-owned banks to quickly implement measures announced by the central bank recently in the right earnest, and to continue focussing on steps to enhance the resilience of their balance sheets. There will be some reaction in fertilizer stocks as the Centre increased its share of subsidy for di-ammonia phosphate (DAP) by 140 per cent from Rs 500 to Rs 1,200 per bag, thereby rolling back the steep 58 per cent hike in prices announced by companies since April. There will be some important result announcements to keep the markets in action.

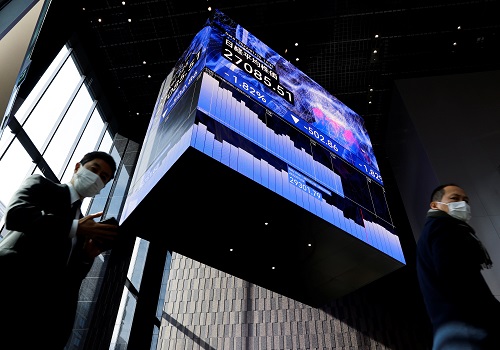

The US markets ended in red on Wednesday after minutes from an April Federal Reserve meeting showed participants agreed the US economy remained far from the central bank’s goals, with some eyeing a future discussion of tapering its bond buying program. Asian markets are trading mostly lower on Thursday after a jittery session on Wall as a hint of tapering talk from the US Fed drove selling in the bond market and lifted the safe-haven dollar.

Back home, Indian equity benchmarks took a breather after two days of solid rally and ended Wednesday’s volatile session with over half percent losses amid selling in the domestic equity market. Weak global cues also dented the sentiments on Dalal Street. Markets made negative start but soon wiped-out losses to trade in green, as traders took some support with report that Union Finance Ministry, on the recommendation of the Panchayati Raj Ministry, released Rs 8,923.8 crore to 25 states for providing grant to rural local bodies. The spread of COVID-19 pandemic in different parts of the country has recently assumed serious proportions. The vulnerabilities of the rural communities need to be especially addressed. But, buying proved short-lived as key gauges once again entered into red terrain in morning deals, as traders were cautious, as smaller non-banking finance companies (NBFCs) have written to the Reserve Bank requesting liquidity support as they continue to face challenges in raising funds. In a letter addressed to RBI Governor Shaktikanta Das, Finance Industry Development Council (FIDC), a representative body of NBFCs, said the announcements made on May 5 by the central bank have addressed liquidity needs of small microfinance institutions MFIs, but NBFCs have missed out. Local equity markets have extended their losses in late afternoon deals and hovered near the lowest point of the day, even as UN data stated that India, China and South Africa have fared ‘relatively better’ than other major economies in imports and exports in the first quarter of this year as global trade recovery from the COVID-19 crisis hit a record high during in the same period. Finally, the BSE Sensex lost 290.69 points or 0.58% to 49,902.64, while the CNX Nifty was down by 77.95 points or 0.52% to 15,030.15.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Benchmarks trade flat with positive bias