MMR, Bengaluru and Pune Currently the Top 3 Cities for Property Investment By Prashant Thakur, ANAROCK Property Consultants

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views On MMR, Bengaluru and Pune Currently the Top 3 Cities for Property Investment By Prashant Thakur, Director & Head - Research, ANAROCK Property Consultants

* Property prices in India's most expensive real estate market (MMR) have bottomed out; unsold inventory declines 6% annually – the highest y-o-y decline in 6 years

* IT/ITeS sectors booming amidst COVID-19 makes Bengaluru & Pune favourite investment destinations; Bengaluru saw unsold stock decline by a whopping 51% in 2020 since 2016

* Pune saw avg. property prices rise by 38% in the last 7 years – highest among all top cities

* Prevailing developer discounts, lowest-best home loan rates & limited period stamp duty cuts make these markets lucrative for long-term investments

Mumbai, 17 March 2021: MMR, Bengaluru and Pune are currently the top three markets for buying homes for end-use and investment. With property prices having bottomed out in MMR - the most expensive real estate region of the country, both investors and end-users are back on the market. The IT/ITeS sectors' post-COVID boom has worked well for the IT-centric realty markets Bengaluru and Pune.

Interestingly, Bengaluru and Pune have, respectively, also been declared the top two most liveable cities of India in the recent Ease of Living Index published by the Ministry of Housing and Urban Affairs (MoHUA). This coveted title further reinforces their attractiveness.

Data indicates that these three cities remained the most active markets in 2020 – together accounting for a 67% share of the total housing sales (of approx. 1.38 lakh units) recorded in the top 7 cities, and 60% of all new launches (approx. 1.28 lakh units).

“Given the ongoing uncertainties in the stock market and financial sector, housing is currently being viewed as one of the safest long-term investment bets," says Prashant Thakur, Director & Head - Research, ANAROCK Property Consultants. "While the stock market prices are at their peak, property prices have bottomed out and various offers and discounts result in further reductions in acquisition costs. Affordability of homes in top cities is also at its best – estimated to be 27% in FY21 as against 53% in FY12.”

Housing prices have been range-bound for the past 7-8 years, but past market dynamics would indicate that the return of demand in these pandemic times will cause prices to harden once COVID-19 stabilizes. From that perspective, MMR, Bangalore and Pune are currently ideal residential investment destinations, with potentially satisfactory price appreciation over the next 5-10 years.

MMR

Despite skyrocketing prices compared to other top cities, the region remains a hot favourite with investors, primarily because of the nation’s financial capital and its strongest economic growth engine – Mumbai. MMR is one of the biggest contributors to India’s overall GDP and thus attracts investors from all over.

MMR's real estate market remained active in 2020, despite the pandemic. Its unsold housing inventory declined by 6% - the highest in 2020 as against the previous years. In the previous 7 years, MMR's stock either increased y-o-y or declined by no more than 3%. Additionally, the ongoing infrastructure projects such as multiple metro links, Mumbai Trans Harbour Link etc. make it a favourable investment destination.

In the current pandemic times, MMR's property prices have bottomed out. Before COVID-19, it was anticipated that average property prices would increase marginally in 2020. Instead, developers beset by inventory pile-up and cost-overruns have been wooing buyers with discounts and offers.

The limited-time stamp duty cut and lowest-best home-loan rates are other added benefits. The cost of property acquisition in MMR has reduced by anywhere between 5-15% - a previously unimaginable scenario. The recent limited-period 50% reduction in construction premiums may further help property prices reduce by 5-7%.

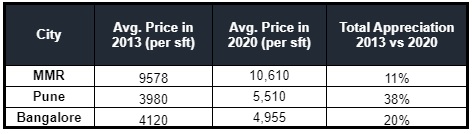

As per ANAROCK research, the average property prices in MMR towards 2020-end were INR 10,610 per sq. ft.

Bengaluru

Bengaluru's housing sector has consistently withstood the test of time, emerging far more resilient than most other major cities - not just before the pandemic but after it, too. While housing sales in other cities picked up only after the relaxation of pandemic lockdowns, Bengaluru housing sales did quite well even during the lockdown.

The fundamentals of the city – right pricing, high-quality products, timely delivery, etc. – give it an edge over other cities. Also, being the predominant IT/ITeS hub, Bengaluru is an evergreen property investment destination. The city saw its unsold stock decline by a massive 51% in 2020 as against 2016 – from 1.21 lakh units in 2016 to nearly 59,330 units as of 2020-end.

As per ANAROCK research, the average property prices in the city currently hover at INR 4,955 per sq. ft. - which is far more affordable than most other top cities.

Pune

Pune has a perfect mix of IT/ITeS, manufacturing and services industries, which gives it a decisive advantage. Moreover, it perpetually presents itself as a significantly more affordable property market than neighbouring Mumbai - while providing a comparable lifestyle - and, going by the recent Ease of Living Index, a better one.

Over a 7-year horizon to gauge price growth across top cities and markets, Pune saw the highest rise of 38% in average property prices between 2013 and 2020. As per ANAROCK research, Pune's average property prices stood at INR 3,980 per sq. ft. in 2013. This increased to INR 5,510 per sq. ft. in 2020 (a 38% jump).

Price movements in the best-performing micro markets of these cities:

Above views are of the author and not of the website kindly read disclaimer