MFs Investor Returns vs Fund Returns - Axis Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Analysis of Indian investor behaviour and its impact on performance

Investor Returns vs. Fund Returns

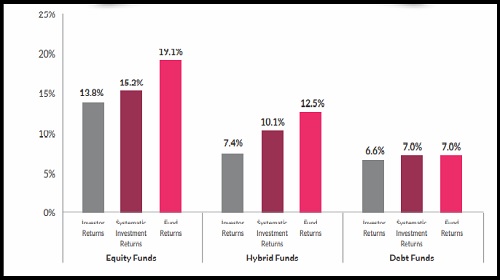

To quantify the effects of Indian investors’ frequent churn decisions on their long-term returns, we analyzed investor behavior for equity and hybrid funds over the last 20 years (2003-2022) and debt funds over the last 14 years (2009-2022). Apart from calculating point-to point investor and fund returns, we also looked at returns delivered through systematic investments (such as SIPs). The chart below summarizes the findings for equity and hybrid funds (over 2003-2022) and for debt funds (over 2009-2022)

The findings of our study indicate that investor returns were significantly worse than both point-to-point fund returns as well as systematic investment returns for all the three categories i.e., equity, hybrid and debt funds. We had similar findings for 5 years and 10 year periods as well

From the chart above, it is clear that excessive and frequent churning dents investor returns (in line with our findings from earlier years). Further, stopping long-term SIPs in response to short-term market corrections defeats the very purpose of SIP, causing lasting harm to the portfolio as investors do not benefit from compounding.

As we can see in the above chart, Gross equity sales has followed the trajectory that the benchmark index NIFTY 50 has laid out which depicts a trend which has been seen in the past as well. This is one of the prime reasons for investor returns being lower than the fund returns. A basic solution to this problem for investors is to stay invested through the complete market cycle rather than chasing a trend during a particular time period

SIPs help mitigate the issue of timing the market through regular, equalized allocations over time and are well-suited for investors who have regular cash flows as they can automatically invest every month/quarter with ease.

Some damaging investment habits to avoid:

* Overreacting to market sentiment. Avoid the greed and fear cycle

* Focusing too much on short-term returns. Avoid chasing short-term performance for long-term gains

* Taking knee-jerk investment decisions. Avoid impulsive investing, rather, invest in a systematic manner to make the most of compounding and rupee cost averaging

* What investors should do to take full advantage of their investments:

* Start early and invest regularly. This way, you stand to gain the full benefit of compounding

* Don’t get swayed by market noise in the short term. Stick to systematic investing even when the market is going through a correction.

* Invest in long-term funds/strategies. Avoid following risky short-term market fads

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

More News

ITI AMC announces activation of new OPA