MCX gold prices are expected to trade with a positive bias - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• MCX gold prices gained marginally around 0.10% on Wednesday amid risk aversion in the global markets

• Further, worries over an increase in inflation, primarily due to rising fuel prices, boosted demand for safe haven assets

• However, a sharp rise in US 10 year treasury yields and an uptick in the dollar index capped further gains in bullion prices

• MCX gold prices are expected to trade with a positive bias due to concerns over escalating geopolitical tensions between western nations and Russia over the Ukraine issue. It is holding above the support of 100 DMA of | 50700. As long as it sustains above this level, it is likely to head towards | 51,100 for the day. Silver prices are also expected to take cues from gold prices and may move towards | 62,200 levels. Additionally, investors will keep an eye on ADP non farm payroll and initial jobless claims data from US

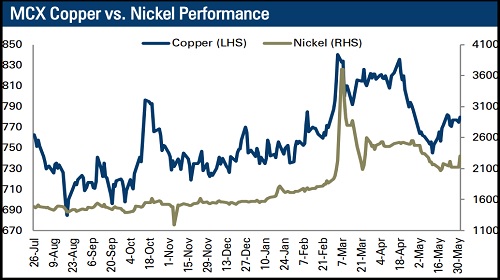

Base Metal Outlook

• LME Copper and other industrial metals prices rallied on Wednesday on the back of better-than-expected manufacturing activity data from China and the US

• The ISM Manufacturing PMI for the US unexpectedly increased to 56.10 in May 2022 compared to 55.40 level in the preceding month on the back of demand for goods remaining strong

• Additionally, copper output in Chile, the world's largest producer of the metal, fell 9.8% to 421,742 tonnes year-on-year in April

• MCX Copper prices are expected to trade in the consolidation range of | 768-782 for the day due to a stronger dollar index. However, a continuous decline in LME stockpiles will continue to support copper prices on lower side. Additionally, investors will keep focusing on factory orders data from the US

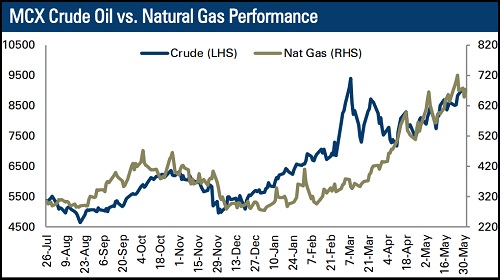

Energy Outlook

• WTI crude oil prices rebounded almost 1.0% on Wednesday after European Union leaders agreed to a phased ban on Russian oil

• In China, Shanghai's strict Covid-19 lockdown restrictions ended on Wednesday, prompting expectations of firmer fuel demand

• An Opec+ technical committee on Wednesday trimmed its forecast for the 2022 oil market surplus by about 500,000 bpd to 1.4 million bpd

• However, Russian oil companies, led by Rosneft this month, plan to reopen wells that they had shut due to Western sanctions. This may continue to pressurise oil prices on the higher side

• MCX crude oil prices are expected to rally towards | 9,250 levels for the day on expectations of a sharp decline in oil inventories from the US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer