MCX copper prices are expected to trade with a negative bias on expectation - ICICI Direct

Bullion Outlook

* Comex gold prices retreated almost 1.0% on Wednesday due to a sharp rise in US dollar index and optimistic sentiments in global markets

* According to Fed meeting minutes, most officials agreed on a halfpoint increase to the Fed’s benchmark short-term interest rate over the next couple of meetings

* However, disappointing macroeconomic data from the US along with rising inflation limited further downsides in bullion prices

* MCX gold prices are expected to trade with a negative bias on anticipation of improved initial jobless claims data from the US. It is holding support at the daily mean levels of | 50,730. A move below this is expected to see it slip towards | 50,400 levels for the day. Additionally, market participant will remain cautious ahead of GDP data from the US

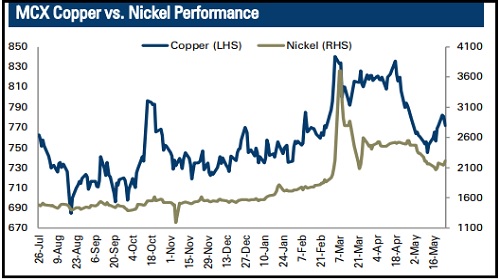

Base Metal Outlook

* MCX copper prices and other industrial metal prices declined on Wednesday amid a unsatisfactory data from the US. New orders for US made capital goods rose less than expected in April 2022

* At the same time, concerns about the global economy's health and stronger dollar index weighed on industrial metal prices.

* MCX nickel prices eased around 1.70% after Russia's Nornickel expected a global nickel market surplus of 37,000 tonnes in 2022

* MCX copper prices are expected to trade with a negative bias on expectation of disappointing pending home sales data from the US. MCX Copper (June futures) price is facing hurdle at 100 DMA (| 784) over the last couple of trading sessions. As long as it sustains below this level, it is likely to retest 200 DMA (| 755) in the coming sessions.

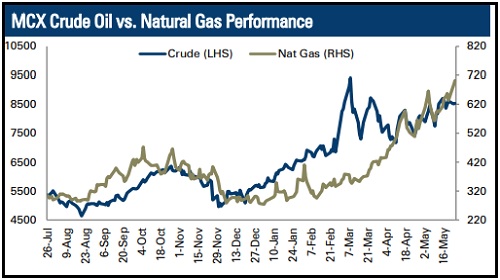

Energy Outlook

* WTI crude oil prices advanced around 0.40% on Wednesday, supported by tight supplies and the prospect of rising demand from the US

* Further, oil prices have been supported by significant decline in US crude oil inventories. According to EIA data, US commercial crude inventories eased to 419.80 million barrels from 420.80 million barrels over the past one week

* US natural gas futures rose more than 2.0% on Wednesday due to significant increase in US LNG exports and strong cooling demand from the US

* MCX natural gas prices are expected to trade with a positive bias for the day amid lower gas flows to Europe from Russia. It is trading above the resistance levels of | 700 levels. As long as it sustains above this level, it is likely to rally towards | 730 for the day. Additionally, investors will keep an eye on storage data from the US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer