Level of 14700 remains crucial for upsides to continue - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Level of 14700 remains crucial for upsides to continue…

* Volatility continued to remain high in the Nifty as both side movements were seen. Dollar index moved to three months high and statement by Fed chairman did not go well with global equities, which saw selling. There was no exception for Indian equites that saw aggressive profit booking on the last day of the week and closed below 15000 levels

* After initial cool off in Volatility index VIX, it again gained momentum and moved towards 26 levels whereas the rupee depreciated almost 30 paise on Friday, which is likely to lead to negative sentiments prevailing as upsides could be limited and selling could be seen at higher levels

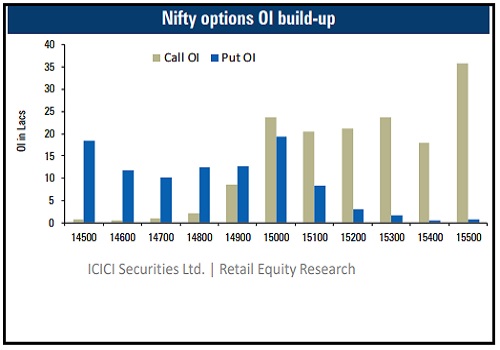

* The Nifty saw 20% OI block on Thursday, which was the highest in recent weeks. Stuck up long positions could limit upsides as traders would look for exit if the Nifty move above Thursday’s high of 15250

* As the Nifty slipped below 15000, writing activity rose in 15300 strike Calls. However, on the Put side, 14500 followed by 14700 strike saw good addition. Due to elevated IVs and writing in OTM strike Calls and Puts we feel the Nifty will consolidate with support now pegged at 14700. For the coming week, it is advisable to create short Strangle strategy in the Nifty by selling 14700 Put & 15300 Call to capitalise on declining time value and retracement in IVs

Bank Nifty: Weakness may extend due to OTM Call writing…

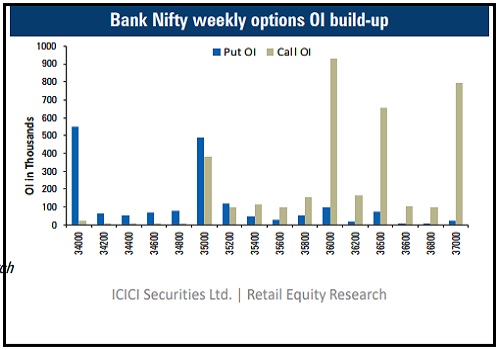

* The Bank Nifty ended almost flat for the week post its sell-off last week. The gains for the week were eroded last Friday as the Bank Nifty saw profit booking. Most private leaders felt the heat whereas PSU banks also gave up their gains last Friday, which kept the Bank Nifty under pressure and forced it to close below 35500

* As there could be downside risk to growth due to sharp surge in Covid-19 cases, negative sentiments prevailed on Dalal Street. The Bank Nifty reverted from 36600, after which fresh short OI blocks were visible, which is likely to trigger some more selling during the week

* The Bank Nifty has the highest Put base at 35000 below which another 1000 points fall could be seen. However, looking at the Call writing positions in OTM strikes, we feel 36500 could act as a hurdle and fresh long could only be seen if the index manages to close above 36500

* The current price ratio of Bank Nifty/Nifty has declined from its recent high. We feel from current levels of 2.36 the ratio is likely to move towards 2.32 while the ongoing underperformance in the Bank Nifty could continue

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

The index fails to sustain above this elevated support zone near 14400 this week it may resu...