Last Friday`s weakness was carried over to Monday as well - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

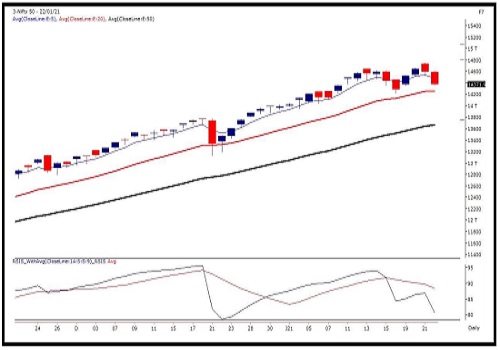

Sensex (48879) / Nifty (14372)

Last Friday’s weakness was carried over to Monday as well and hence, Nifty witnessed a decent corrective move on the opening day to test sub-14300 levels. However, the bulls were not ready to give up easily as they came back strong on the subsequent two sessions on the back of overall global optimism. In the process, almost all major sectoral indices registered their new record highs.

Everything looked hunky dory until the sudden profit booking took place in the last hour of the weekly expiry. This sell off went on to intensify on the last day of the week to erase all weekly gains to conclude tad below the 14400 mark. Early in the week, markets took a smart U-turn on lot of positivity across the globe. Although, new highs were being hit, we were not convinced with the move and we had clearly stated this in our intraweek commentary.

The main reason behind this was indices (NIFTY, BANKNIFTY and NIFTY MIDCAP 50) making new highs with the 3- points Negative Divergence in the RSI-Smoothened oscillator on daily chart. Such divergence with 3 points is generally considered a sign of caution and hence, repeatedly we advised not getting carried away by the euphoria. Now, although Nifty has not broken any major supports, the development in BANKNIFTY does not look encouraging at all. In fact, the entire banking and financial space was the major culprit behind Friday’s correction as they took a solid knock.

To be specific, BANKNIFTY has confirmed a double top pattern on daily chart and has broken its important swing low with an ease. The weekly chart of the same exhibits a confirmation of ‘Long Legged Doji’ pattern. For Nifty, the important support to watch out would be 14222, below which the recent bullish structure will get distorted to extend the correction towards 14000 – 13800 levels

On the higher side, 14500 – 14632 would be seen as immediate hurdles.Historically, it is rare to see a major trend reversal ahead of any mega event. Hence, it would be interesting to see how things pan out in this week as the Union Budget is around the corner. Looking at the price development, it does not look encouraging. All eyes should be on the financial space; because if further weakness has to come, it would certainly be led by this space. We continue to advise staying light on positions and should ideally avoid creating leveraged positions ahead of the budget (especially in high beta counters). With a broader view, if any significant correction comes, it would be a great opportunity to accumulate quality propositions in a staggered manner.

Nifty Daily Chart

Nifty Bank Outlook - (31167)

On Friday, the Bank Index started on a weak note and with bearish momentum throughout the session ended with a loss of 3.17% at 31167. During the last week, we remained cautious on the Bank Index and we mentioned a stiff resistance around the 32700 - 33000 mark. On Thursday, despite Bank Nifty making a fresh new high, it failed to sustain above the mentioned levels that triggered a selloff in the last hour of the weekly expiry day.

A follow-up selling was seen on Friday resulting in a Double Top bearish breakdown and now we sense the bank index is likely to see further weakness going ahead in the near term. Traders are advised to keep light on banking stocks and use any bounce to exit longs. As far as levels are concerned 31500 - 31650 is the immediate resistance whereas on the flip side 30900 - 30750 is the next support zone

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One