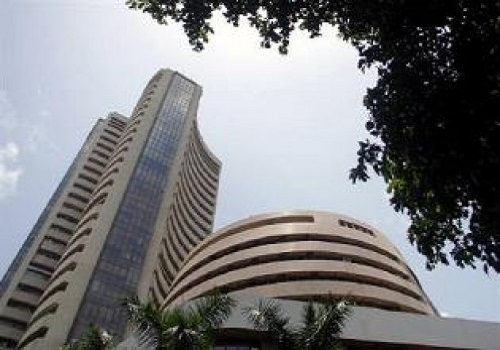

Indian shares end lower for seventh session; await RBI policy

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian shares ended lower for seventh straight session on Thursday, dragged by tech stocks, ahead of the central bank's policy outcome on Friday amid lingering fears of a global recession.

The NSE Nifty 50 index fell 0.24% to 16,818.10, while the S&P BSE Sensex dropped 0.33% to 56,409.96. Both the indexes saw their worst losing streak since mid February.

Investors pedalled into another cycle of selling on Thursday as the dollar tightened its hold on the currency markets, while recession fears sapped stocks. [MKTS/GLOB]

"Traders preferred to cut their position in some of the rate-sensitives ahead of the credit policy announcement," said Shrikant Chouhan, head of equity research (Retail), Kotak Securities.

"The market is already in an oversold position and if the rate hike is above the estimate, then we could see bouts of intra-day volatility with a negative bias for some more time."

Foreign institutional investors have sold nearly 106.97 billion Indian rupees ($1.31 billion) worth equities so far into the week until Wednesday, National Stock Exchange data showed.

"A near-record Indian equity valuation premium to

peer markets as well as to domestic bonds indicates a kind of decoupling for Indian bonds as well as equity markets," CLSA said in a note.

"We do not expect this to be sustainable and regard it as indicative of a very low margin of safety. A simple valuation mean reversion anchored on bond yields indicates fears of 30% downside in the Nifty," the brokerage said.

The Nifty and Sensex are down nearly 3% so far this year.

The Nifty IT index fell 0.9%, while the energy index dropped 0.8%.

Oil & Natural Gas Corp was the top Nifty 50 gainer, rising 3.4%, while Asian Paints the top loser, falling 5.2%.

($1 = 81.7780 Indian rupees)