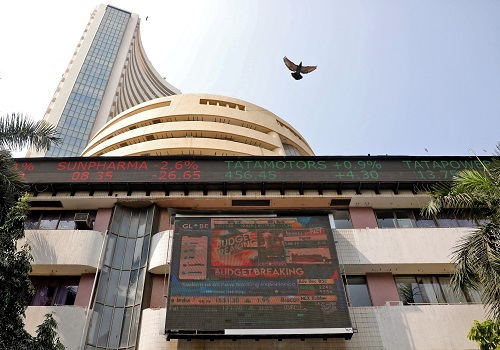

Indian shares decline ahead of inflation data, IT earnings

Indian shares swung between gains and losses before settling lower on Wednesday, as caution prevailed ahead of key corporate earnings as well as domestic and U.S. inflation data, due later in the day.

The Nifty 50 index closed 0.28% lower at 19,384.30, while the S&P BSE Sensex fell 0.34% to 65,393.90.

Six of the 13 major sectoral indexes logged gains, with public sector banks rising 0.83%.

The high weightage IT fell 0.71% and was the top sectoral loser, ahead of first-quarter results from Tata Consultancy Services and HCLTech, due after market hours.

Several brokerages have warned of a muted quarter for the IT sector as clients in the United States and Europe - two of the sector's largest markets - cut spending.

"From here on, any runaway rally is unlikely, especially with rising concerns over food inflation due to uneven monsoons," said Samrat Dasgupta, chief executive officer at Esquire Capital Investment Advisors.

"Advise investors to be cautious and utilise a buy-the-dip approach. The Nifty 50 has strong support near 18,900-19,100 levels, but the gains could be capped due to elevated valuations."

The Nifty 50 and Sensex have both risen over 11% so far in fiscal 2024.

India's retail inflation likely snapped a four-month decline in June due to rising food prices, a Reuters poll of economists showed.

State-owned lenders Indian Bank and Union Bank rose more than 4% and 1%, respectively, after global brokerage Investec initiated coverage with "buy", citing valuation comfort in tier-2 public sector lenders.

Online gaming firm Delta Corp tumbled over 23% while Nazara Technologies and Onmobile Global lost between 1% and 3.5% after the government imposed a 28% tax on the turnover of online gaming companies.

Asian and European equities rose over 0.7% ahead of the U.S. inflation data. [MKTS/GLOB]