Indian bond yields jump, rupee strengthens as RBI eyes policy normalisation

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

BENGALURU - Indian bond yields jumped to near three-year highs and the rupee strengthened after the central bank hinted at gradually moving away from its ultra-loose monetary policy to counter inflation.

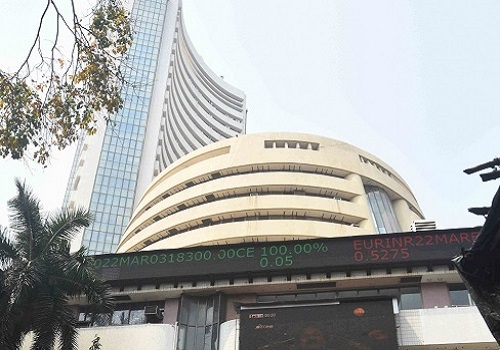

Stocks ended higher after three sessions of losses. The NSE Nifty 50 index .NSEI saw a late surge, ending up 0.82% to 17,784.35, while the S&P BSE Sensex .BSESN rose 0.7% to 59,447.18.

The central bank kept the lending rate, or the repo rate INREPO=ECI, steady at 4% as widely expected and stuck to an accommodative stance to support a post-pandemic economic recovery that remained tepid. (Full Story)

However, it raised the 2022/23 inflation forecast by 120 basis points from February to 5.7% amid risks from the Russia-Ukraine war. It also cut economic growth expectations to 7.2% from 7.8%.

As a first step towards policy tightening, the central bank said it would restore the width of the liquidity adjustment facility corridor to 50 basis points.

Prithviraj Srinivas, Chief Economist, Axis Capital, Mumbai, said the RBI has changed its stance to "more hawkish" and the increase in inflation forecast is a bit more than expected.

The move follows nearly two years of record-low repo rate and comes against the backdrop of the U.S. Federal Reserve and other global peers starting to raise rates to counter a price surge.

"The review shows the RBI is ready to steer monetary policy out of crisis level accommodation," Srinivas said.

India's inflation has breached the 6% upper limit of the central bank's target range for two months. Economists polled by Reuters had expected the RBI to wait at least a few more months to raise interest rates. (Full Story)

The 10-year benchmark bond yield IN065432G=CC rose 15 basis points to 7.075%, while the rupee INR=IN strengthened against the dollar to 75.71 from 75.97 after the policy announcement.

(Reporting by Nallur Sethuraman in Bengaluru; Editing by Devika Syamnath)