India requires an active, counter-cyclical fiscal policy: Economic Survey

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

India requires an active fiscal policy which will ensure accrual of overall benefits from Centre's seminal economic reforms, said Economic Survey 2020-21 on Friday.

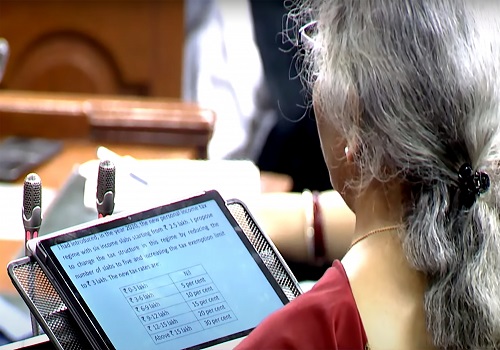

The survey document which was tabled by Finance Minister Nirmala Sitharaman in the Parliament cited fiscal multipliers are disproportionately higher during periods of economic crises than booms.

"Thus, as the Covid-19 pandemic has created a significant negative shock to demand, an active fiscal policy can ensure the full benefit of seminal economic reforms taken by the government," the survey said.

"As the IRGD is expected to be negative in the foreseeable future, a fiscal policy that provides an impetus to growth will lead to lower, not higher, debt-to-GDP ratios."

The Economic Survey examined the optimal stance of fiscal policy in India during a crisis and concluded that it is growth that leads to debt sustainability and not necessarily vice-versa.

Besides, the survey noted that the phenomenon of a negative IRGD in India, unlike advanced economies, is not due to lower interest rates but much higher growth rates.

Consequently, the trend has prompted a debate on saliency of fiscal policy, especially during growth slowdowns and economic crises.

According to the survey, simulations undertaken till 2030 highlight that, given India's growth potential, debt sustainability is unlikely to be a problem even in the worst-case scenarios.

The survey highlighted that a well-designed expansionary fiscal policy stance can contribute to better economic outcomes as it can boost potential growth with multi-year public investment packages that raise productivity and mitigate the risk of Indian economy falling into a low wage-growth trap, like Japan.

In addition, it pointed out that a time of excessive risk aversion in the private sector, as seen during an economic crisis, risk-taking via public investment can catalyse private investment, leading to a crowding in, than a crowding out.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">