From savings to spending: What new IT rules tell us about Government intentions

The government is moving India away from a saving economy -- the old Income Tax (IT) regime loaded with tax deduction investments -- to a spending economy by luring people to a new IT regime that is sans any tax savings investments, said chartered accountants.

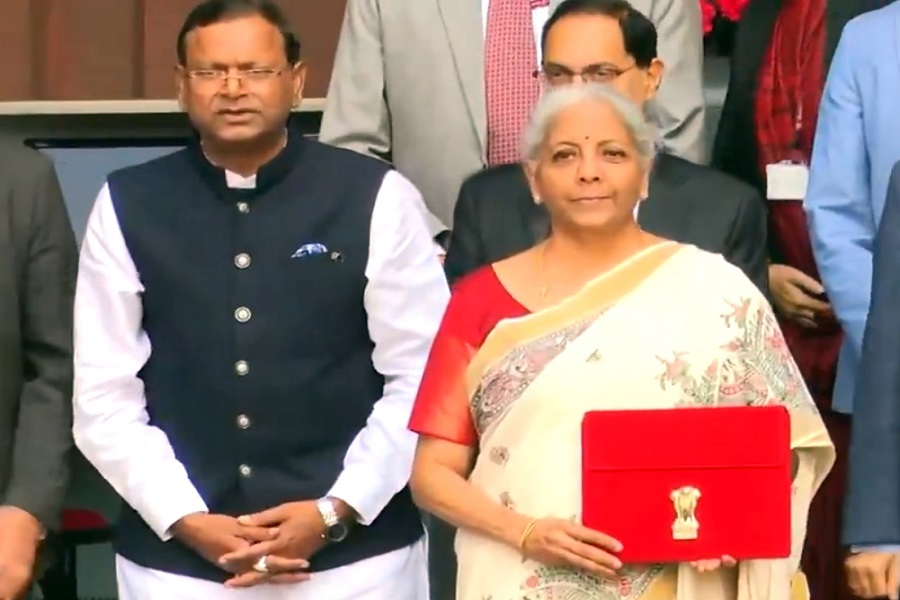

It is also being said that Finance Minister Nirmala Sitharaman's budget 2023-24 proposal of taxing the maturity and surrender amount of non-ULIP policies (purchased after April 1, 2023, if the total premium paid by an individual under such polices is more than Rs 5 lakh in a year, is a step towards the new IT regime.

Presenting her budget on February 1, 2023, Sitharaman said the new IT regime will be the default one but those tax payers wanting to continue with the old one can still do so.

In order to enthuse IT payers to the new regime, Sitharaman increased the rebate limit to Rs 7 lakh from the earlier Rs 5 lakh.

In other words, people with an income up to Rs 7 lakh need not pay any IT. In addition, she also reduced the number of tax slabs, extended the Standard Deduction and reduced the highest surcharge rate.

"The government continues with dual tax rate slabs - Old and New. The Old tax slab regime which promoted savings by allowing tax deduction has now become an unwanted child of the government. A lot of concessions are given to the new child - the new IT regime leaving the old one destitute," S.Jaishankar, a chartered accountant, told IANS.

"The government has expressly opined that it wants the tax payers to move away from the savings syndrome to consumption syndrome. Only with more consumption the gross domestic product (GDP) grows faster. All along the tax payers were investing in LIC not only for tax deduction but it was also giving financial security to meet the family needs like marriage, education. The government seems to tamper with this basic security," Jaishankar added.

Continuing, he said a government that wants the tax payers to move away from tax deduction mode, should also ensure that an income is not taxed at multiple levels.

Take company dividends for instance, the corporate pays around 27 per cent and the individual pays another 10 or 20 per cent, Jaishankar said.

Experts also pointed out that Indians pay goods and services tax (GST) on almost all the goods/services they consume and in addition there is IT.

"Today tax saving instruments are the ones that provide a sort of social security to individuals in India as the country doesn't have a proper social security net," P.S. Prabhakar, a practicing chartered accountant, told IANS.

The government can even abolish the IT for salaried class as the net revenue from this source after the staff salaries, pensions, will not be great, said a couple of commoners.

"Despite its advantages, the Sovereign Gold Bonds (SGB) introduced a few years back, it is still not popular. The government is also not serious about it. The investment in SGB is blocked for a minimum of 5 years. The government should have relaxed it to make it more popular. The gold smuggling economy is a parallel economy and thrives on jewel crazy Indians," Jaishankar added.

Queried about the dual tax regime Sitharaman said they would continue to exist.

On the view that the government is moving towards a consumption economy Sitharaman wondered why this narrative is being set up.

"The government's intent is clear - simplifying direct tax. The individuals can stay under the old regime. In the old regime, the tax rate is high and there were deductions. In the new regime, the tax rate is low. There is more money in the people's hands and they can decide where to invest to take care of the family needs," Sitharaman said.

According to her, the investment avenues are still available and the individuals can choose where to invest rather than being directed where to invest by the tax law.

Under the old tax regime, various tax deductions under Section 80 of the IT Act and other Sections were available.

Some of the tax saving measures were life insurance premium, fixed deposits, National Savings Certificate, ELSS, tuition fees for children, housing loan repayment, investment in Sukanya Samriddhi Scheme, contribution to pension fund of insurers, National Pension Scheme, Infrastructure Bonds, Health Insurance Premium and others.

Be that as it may, for people having an income of Rs 7 lakh the tax liability is nil from the next assessment year -- 2024-25. Others have to compute their tax liability under the old -- with tax saving measures -- and the new regime to see which one is advantageous for them.

The new tax rates under the new regime are:

Annual Income: IT Rate

Rs 0-3 lakh Nil

Rs 3-6 lakh 5 per cent

Rs 6-9 lakh 10 per cent

Rs 9-12 lakh 15 per cent

Rs 12-15 lakh 20 per cent

Above Rs 15 lakh 30 per cent