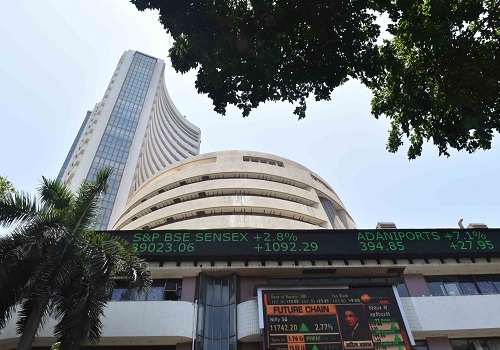

India likely to propose removing long-term tax benefits for debt mutual funds

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

India may propose that investments in debt mutual funds be taxed as short-term capital gains, according to a source with knowledge of the matter, a move that could strip investors of the long-term tax benefits that made such investments popular.

Mutual funds with less than 35% invested in equity shares are proposed to be treated as short-term and indexation benefits available to such funds may be removed prospectively, the source said. This could translate to higher taxes for the funds.

As such, the tax rate applicable would be based on the income tax slab in which the investor falls.

This could reduce inflows in debt mutual funds and benefit bank deposits.

Currently, investors in debt funds pay income tax on capital gains according to the income tax slab for a holding period of three years. After three years these funds pay either 20% with indexation benefits or 10% without indexation.

The proposed changes are likely to be part of the finance bill amendments that could be tabled in the parliament on Friday.

The source did not want to be named as amendments to the finance bill, 2023 are yet to be presented in the parliament.

Finance Ministry did not immediately respond to an email seeking comment.