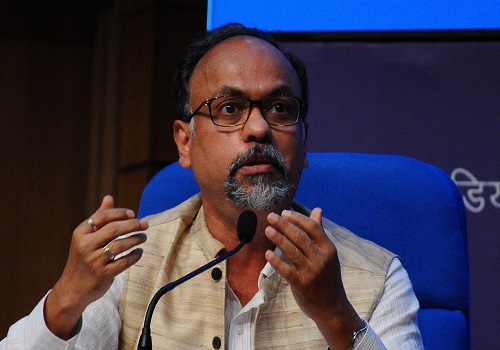

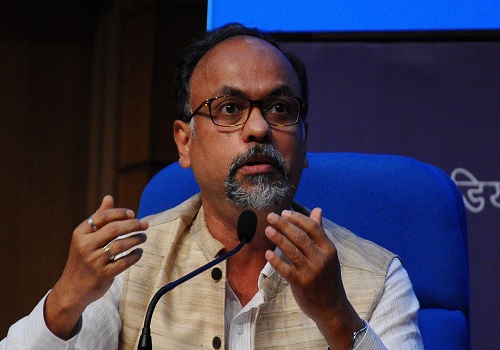

Global Fintech Fest 2023 : IRDAI Chairperson Debashish Panda says IRDAI exploring flexible, DIY insurance products

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

"IRDAI is actively pursuing reforms in the insurance sector to enhance its adaptability and responsiveness. We are currently at a juncture marked by personalized offerings and shifting consumer preferences. To meet these changes, we are exploring flexible, do-it-yourself insurance products, leveraging advisory technologies and digital assistants. We anticipate a future where insurers can efficiently manage large and diverse data sources, harnessing quantum computing to revolutionize risk assessment and decision-making, thereby significantly improving the insurance lifecycle,” said Shri Debasish Panda, Chairperson, Insurance Regulatory and Development Authority of India (IRDAI) during his special address at the Global Fintech Fest 2023 here today.

Shri Panda extensively discussed new technological developments lined up for the Insurtech sector, and said, “AI algorithms combined with machine learning models and predictive analysis will be leveraged to make underwriting an essential process in the insurance industry. Process automation will help increase the speed of traditional process that required manual intervention. Further, conversational AI will be harnessed in the Insurance industry throughout the value chain and will help customers by assisting them during various stages of insurance procurement to claim process.”

Underlining his vision for the future of the sector, Shri Panda said, “It is safe to say that smart contracts, parametric triggers and decentralised insurance would be the future. Simple, fast, automated and efficient – that is where we want to reach. Accessibility, availability, awareness, choiceness, healthy competition all led by technology is the way forward.”

Highlighting India’s ‘stunning’ progress in fintech the IRDAI Chairperson said, “While developing countries are still drawing cheques, our country has already harnessed the power of ‘Direct Benefits Transfer’”

The session was moderated by Sarbvir Singh, Joint Group CEO, PB Fintech.

GFF 2023, the largest thought leadership platform in the world, is supported by the Ministry of Electronics and Information Technology (MietY), the Department of Economic Affairs (DEA), Ministry of Finance, the Reserve Bank of India (RBI), and the International Financial Services Centres Authority (IFSCA) and is organized by the Payments Council of India (PCI), Fintech Convergence Council (FCC), and National Payments Corporation of India (NPCI).

Among the leading international agencies that are partnering with GFF 2023 are the World Bank, the Global Knowledge Partnership on Migration and Development (KNOMAD), the Consultative Group to Assist the Poor (CGAP), and Women’s World Banking. Australia, Brazil, the United Kingdom, Germany and Israel are the Country Partners of GFF 2023.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">