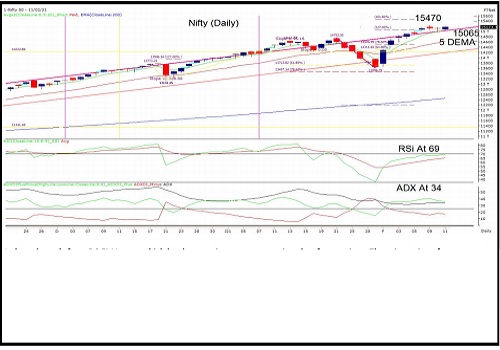

Index rebounds from 5 DEMA zone which has been acting as a support since last few sessions -Tradebulls

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

Index rebounds from 5 DEMA zone which has been acting as a support since last few sessions. There is no sign of any incremental strength or weakness as the index witnessed yet another narrow ranged body on its daily scale. It continues to display steady strength as it registered yet another closing above its 5 DEMA & the psychological mark of 15000.

Its daily RSi is quoting around 68 with ADX trending well at 34 compliments strength within the short term consolidation. Options data now indicates a squeezed range of 15100-15300 which may attract momentum once a close is established outside the same. As there is no sign of weakness the ongoing rally is expected to stretch towards 15470 gradually. Traders should continue to trade momentum until its previous days swing low is not breached consecutively .

Buy on declines remains a prudent strategy as index scales above its life high. Major key level for the index now rests around 15470 while on the flipside 14930 has developed as an elevated support zone & a prudent stop for trading momentum.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.tradebulls.in/Static/Disclaimer.aspx

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Daily Market Analysis : The markets traded lackluster and ended slightly lower, continuing t...