In the coming session, index is likely to open gap down amid weak global cues - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: 16167

Day that was…

Equity benchmarks continued their losing streak for fourth session in a row ahead of key US and domestic inflation data. The Nifty closed the session at 16167, down 73 points or 0.45%. Broader markets extended underperformance led by small cap index which was down 3%. Sectorally, IT underperformed (down 1.2%) while private banks relatively performed well (+0.5%)

Technical Outlook

• The Nifty traded volatile as the selling pressure continued for most part of the day after positive open, leading index towards psychological mark of 16000, where buying efforts emerged in late hour of trade. As a result, price action formed a bear candle with lower high-low with lower shadow indicating late recovery • In each of past seven sessions, index has formed lower high on daily time frame. After a gap down open on Thursday, holding Wednesday’s panic low of 15992 would lead to a breather in downward momentum from oversold readings (weekly stochastics 10). However, a decisive close above previous session high would be required for the meaningful pullback to materialise. On the contrary , breach below 16000 (on a closing basis) would lead to panic selling in coming sessions leading index towards March low of 15700.

• We note that past four weeks corrective move hauled daily and weekly stochastic oscillator in extreme oversold territory (currently placed at 14 and 10). Historically, after approaching such lower reading, markets have witnessed technical pullback. Thus, we advise traders to refrain from creating aggressive short position. Instead, use dips to construct portfolios in quality stocks in a staggered manner. Immediate upsides are capped at recent breakdown area of 16800, which is also value of 200 dma

• Historically, over past two decades, on 16 out of 20 occasions despite transitory breach (not greater than 5%) of 52-week EMA (currently 16600) index has generated decent returns in subsequent 3 month and 6 months. In current scenario 5% from 200 days EMA will mature at 15700 • The broader market indices continued to underperform with lower high-low formation and small cap index breaking February lows. We expect pullbacks to be short lived and selective in this space

In the coming session, index is likely to open gap down amid weak global cues. Post gap down opening we expect supportive efforts to emerge from 15900 zone. Hence, use dip towards 15920-15955 should be used for creating long position for target of 16037

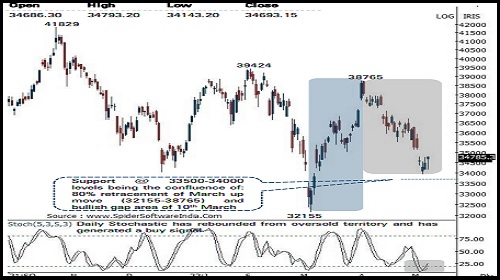

Nifty Bank: 34482

Day that was :

The Bank Nifty relatively outperformed for the second consecutive session as it recovered its entire first half decline to close the session higher by 0 . 6 % on Wednesday . The index recovered more than 650 points in the second half of the session from the intraday low (34143 ) lead by the heavyweights from the PSU and private banking space . The Bank Nifty closed the session at 34693 levels up by 210 points or 0 . 6 % on Wednesday

Technical Outlook

• The daily price action formed a bullish hammer like candle with a small real body and a long lower shadow . The index in the process maintained higher high for the second consecutive session signaling buying demand emerging around the support area of 34000 amid oversold placement of the daily and weekly stochastic oscillators

• Key support for the index is placed at 33500 -34000 levels being the 80 % retracement of the entire March up move, holding above the same will keep pullback option open . Failure to do so will lead to an extended correction . Immediate upsides are capped at 36000 levels

• Index has stiff hurdle around 36000 levels being the confluence of last Thursday high and the 38 . 2 % retracement of current decline (38765 -33927 )

• The index has witnessed a shallow retracement of its preceding up move and has already taken almost six weeks to retrace just 61 . 8 % of its preceding four weeks up move (32156 -38765 ) . A shallow retracement signals a higher base formation . The index has support around 33500 -34000 levels as it is confluence of :

• (a) 80 % retracement of the entire March 2022 up move (32155 - 38765 ) placed at 33500 levels

• (b) bullish gap area of 10th March 2022 is also placed around 33700 levels

• Among the oscillators the daily stochastic has generated a buy signal moving above its three periods average as it is seen rebounding from the oversold territory

• Among the oscillators the weekly stochastic is placed at an oversold territory with a reading of 17 signaling an impending pullback in the coming weeks In the coming session, index is likely to open on a soft note amid weak global cues . We expect index to trade in a range while holding above Tuesday low (34218 ) . Hence after a negative opening use intraday dips towards 34190 -34270 for creating long position for the target of 34530 , maintain a stoploss at 34080

In the coming session, index is likely to open gap down amid weak global cues . We expect the index to hold above the support area of 34000 and witness a pullback . Hence use intraday dips towards 34020 -34100 for creating long position for the target of 34370 , maintain a stoploss at 33910

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct