IIP contracted by 4.0% in Oct 2022, led by higher number of holidays; high frequency indicators portend rebound in Nov 2022

HIGHLIGHTS

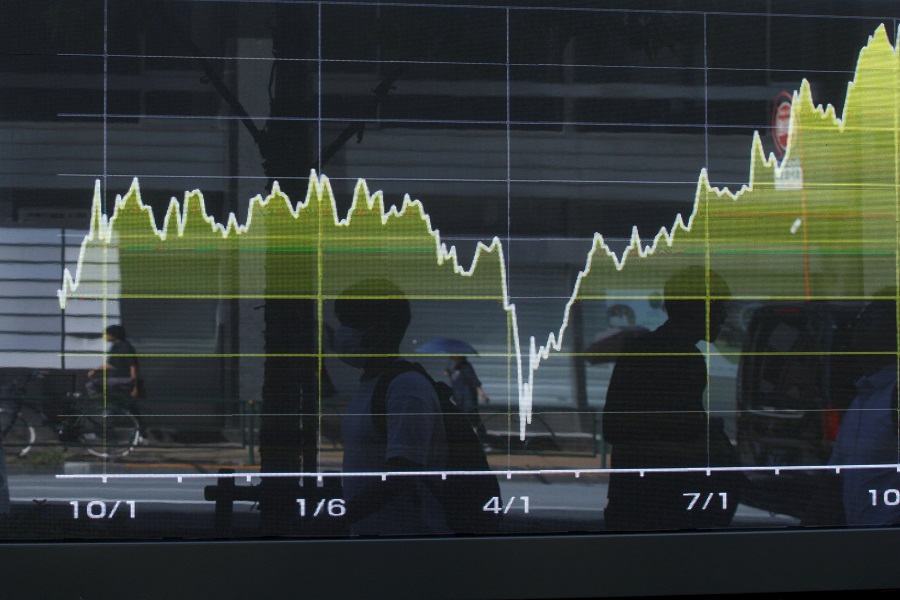

The Index of Industrial Production (IIP) slipped into a year-on-year (YoY) contraction of 4.0% in October 2022 (ICRA’s exp: -1.3%), after having posted a growth of 3.5% in September 2022, mirroring the anaemic performance of exports. Holidays during the festive period led to a broadbased deterioration across all the sub-sectors as well as use-based categories in October 2022, vis-à-vis September 2022. Relative to the preCovid levels of 2019, the IIP reported a modest 4.5% rise in October 2022, in spite of consumer goods and capital goods trailing their respective pre-Covid volumes. Encouragingly, the YoY growth of most available high frequency indicators improved in November 2022 relative to October 2022, reflecting the subdued base owing to the relatively late onset of the festive season in 2021 vis-à-vis 2022, portending a rebound in the IIP’s performance just-concluded month. Given that the YoY growth in both these months is impacted by base effects, we believe that an average performance of October and November 2022 would provide a better gauge of the actual growth momentum and demand dynamics.

• IIP contracted by 4.0% YoY in October 2022: Led by a higher number of holidays in October 2022, relative to October 2021, the IIP slipped into a 26-month low YoY contraction of 4.0% in October 2022 (+3.5% in September 2022), with a deterioration across all the sub-sectors, i.e. manufacturing (to a 26-month low -5.6% from +2.2%), mining (to +2.5% from +5.2%), and electricity generation (to +1.2% from +11.6%).

• Output of four of the six use-based categories declined in October 2022: All of the six use-based categories displayed a deterioration in their YoY performance in October 2022, vis-à-vis September 2022. The output of intermediate goods (to -2.8% from +1.7%) and capital goods (to -2.3% from +11.4%) slipped into a YoY contraction in October 2022. Additionally, the output of consumer non-durables (to -13.4% from -6.3%) and consumer durables (to -15.3% from -3.2%) continued to contract for the fourth and third consecutive month, respectively, in October 2022, with the latter partly reflecting the weakness in several export categories in the month.

• IIP exceeded the pre-Covid level by a modest 4.5% in October 2022: This was led by a double-digit expansion in electricity (+16.1%) and mining (+13.1%), followed by a relatively lower growth in manufacturing (+1.9%), relative to the pre-Covid levels of October 2019. Further, 10 of the 23 sub-segments within manufacturing (with a weight of 41.8% in the IIP) recorded a higher output in October 2022 as compared to the October 2019 levels. Among the six use-based categories, output of consumer non-durables (-6.5%), consumer durables (-3.2%), and capital goods (-0.9%) trailed their respective pre-Covid volumes in October 2022.

• Low base boosted YoY growth of most high frequency indicators in November 2022, portending rebound in IIP: The YoY growth of most available high frequency indicators improved in November 2022 relative to October 2022, partly reflecting the subdued base owing to the relatively late onset of the festive season in 2021 vis-à-vis 2022. Given that the YoY growth in both these months is impacted by base effects, we believe that an average performance of October and November 2022 would provide a better gauge of the actual growth momentum and demand dynamics.

Above views are of the author and not of the website kindly read disclaimer