Formalisation of economy behind big increase in corporate tax collection

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Among the various factors which may have led to a big increase in corporate tax collection, improved profitability of the corporates, formalisation of the economy and improved compliance due to tax reforms are noteworthy, the Economic Survey for 2021-22 noted.

The corporate income tax registered a growth of 90.4 per cent over April-November 2020 and 22.5 per cent over April-November 2019.

Large firms have become larger at the cost of smaller firms, while informal sector firms have been disrupted, said HSBC in a recent report.

Those earning their livelihoods from small and informal firms have suffered. This is a problem because 80 per cent of India's labour force is employed in the informal sector, and roughly half of them who are in the non-agricultural sector have borne the economic brunt of the pandemic, the report added.

The rise in inequality also holds significance for the investment cycle. In the period when India's investment rate was falling, a closer look reveals that it wasn't the public sector or the private corporations leading the fall. Rather, it was private household investment that was falling sharply, the report said.

This category includes a bulk of the small businesses in the economy. It was already a hurting and underperforming sector even before the pandemic. There may also be a funding angle to the large fall in household investment in the FY13-FY20 period. With NPLs on the rise, risk averse banks slowed credit outgo, particularly to the industry.

Large firms had access to capital markets while overall reliance on banking sector credit fell small firms, which don't have as much access to capital markets, and are likely to have suffered.

While many banks are keen on increasing credit to small firms this time around, whether or not it rises significantly is an area to track.

The Economic Survey noted that as per RBI, the gross profits of Listed Non Government Non-Financial Companies(sample) had grown by 132.5 per cent for manufacturing sector and 21.5 per cent for IT sector during Q1 of 2021-22. In the following quarter Q2 of 2021-22, gross profits grew by 39.7 per cent for manufacturing sector and 18.4 per cent for IT sector.

In addition, various tax administration and policy reforms introduced by the government of India over the past few years have also led to improved compliance.

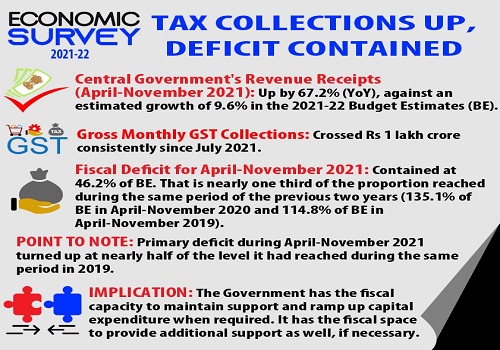

The period from April to November 2021 witnessed strengthening of the fiscal position by the Centre, which was led by buoyant revenue collection and expenditure allocations targeted towards capital expenditure.

Revenue receipts have grown at a much higher pace during the current financial year (April to November 2021) compared to the corresponding period during the last two years. This performance is attributable to considerable growth in both tax and non-tax revenue.

Net tax revenue to the Centre, which was envisaged to grow at 8.5 per cent in 2021-22 BE relative to 2020-21 PA, grew at 64.9 per cent during April to November 2021 over April to November 2020 and at 51.2 per cent over April to November 2019.

This improved performance in tax revenues is due to high growth shown by all major direct and indirect taxes with respect to the same period of the last two years. Within direct taxes, personal income tax has grown at 47.2 per cent over April-November 2020 and at 29.2 per cent over April-November 2019.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">