Equity indices settle low amid high volatility, rupee recovers a tad

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

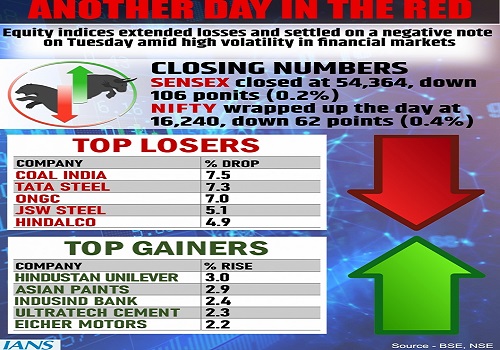

Equity benchmark indices extended their losses from the previous session and settled on a negative note on Tuesday, amid high volatility in overall financial markets.

Sensex closed at 54,364 points, down 106 points or 0.2 per cent, whereas Nifty, at 16,240 points, was down 62 points or 0.4 per cent.

Among sectors, metals, power and realty fell the most while banks and FMCG ended mildly in the positive. BSE Midcap and Smallcap indices severely underperformed, falling 1.98 per cent and 2.11 per cent,respectively.

"Asian equities slipped to their lowest in nearly two years overnight, before trimming losses," said Deepak Jasani, Head of Retail Research, HDFC Securities.

A fall in financial liquidity is expected to slow down the economy and the pricing of equities.

"Oil prices are declining further on worries of Chinese lockdown, rising dollar and risk of recession. Metal stocks are losing its shine as the sector's outlook is turning negative due to persisting margin pressures," said Vinod Nair, Head of Research at Geojit Financial Services.

Ajit Mishra, VP - Research, Religare Broking, reiterates his bearish stance on the markets, in absence of any positive trigger.

"Participants shouldn't read much into a single-day rebound and wait for some decisive reversal signal. Besides, stability on the global front is equally critical for any sustained move. Meanwhile, since most of the sectors are trading under pressure, the focus should be on stock selection and using intermediate rebound to create shorts," said Mishra.

Besides, the rupee recovered some of its losses and ended at 77.32 against the US dollar on Tuesday, a day after depreciating to it's all-time low of 77.44 against the greenback.