Equity benchmarks stated the week on a buoyant note - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Technical Outlook

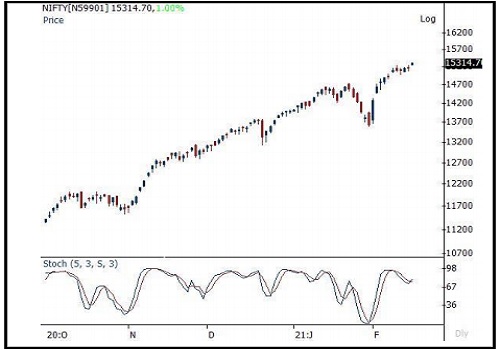

Equity benchmarks stated the week on a buoyant note. Nifty scaled to fresh all time high of 15340 and settled Monday’s session at 15315, up 151 points or 1%. In the coming session, we expect index to witness follow through strength to recent consolidation breakout (15257-14977).

Hence, use intraday dips towards 15290-15315 to create long position for the target of 15398 Going head, we reiterate our constructive stance on the Nifty and expect it to head toward our earmarked target of 15500 in the coming weeks as it is 161.8% external retracement of last fall (14754-13596), at 15466.

Key point to highlight is that, the Bank Nifty has reordered a flag breakout, indicating acceleration of prevailing uptrend which augurs well for extension of ongoing rally toward 15500 in Nifty, as Bank Nifty components carries 35% weightage in Nifty. Structurally, the formation of higher peak and trough on the larger degree chart signifies robust price structure which makes us confident to revise support base upward at 14900.

Nifty Daily Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Quote on F&O Expiry by Mr. Chandan Taparia, Head, Equity Derivatives & Technicals, Wealth Ma...