Equity benchmarks concluded weekly derivative expiry session on a subdued note - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Technical Outlook

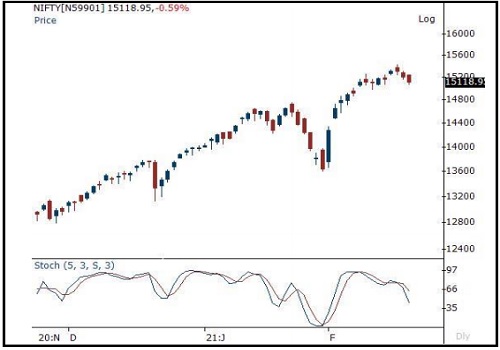

Equity benchmarks concluded weekly derivative expiry session on a subdued note. The Nifty settled the session at 15119, down 90 points or 0.6%. In the coming session, Nifty future is likely to open on a negative note tracking weak global cues.

We expect index to extend the ongoing breather amid stock specific. Hence, after a gap down opening use intraday pullback towards 15140-15165 to create short position for target of 15052. Going ahead, we expect index to extend the ongoing healthy retracement towards 14900 in coming sessions amid stock specific action, wherein midcap and small caps would continue to relatively outperform.

We believe, ongoing breather after a sharp post Budget rally of 13% would help the index to cool off the extreme overbought conditions of weekly stochastic oscillator (currently placed at 90) and form a higher base. Meanwhile, upside will be capped at 15500 as it is 161.8% external retracement of the last fall (14754-13596), at 15466.

Nifty Daily Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct