Derivatives Strategy – Reverse Collar Sell Nifty For Target Of Rs. 14300 By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rationale

* On the weekly expiry day, Nifty and the Bank Nifty reverted sharply from its highest Call base along with sharp rise in volatility. Follow up selling continued where option blocks are visible since morning.

* 14600 and 14700 strike Calls saw addition of 14 lac shares and 15 lacs shares respectively whereas Put OI blocks are observed in OTM strike indicating more downsides.

* Profit booking is expected in sectors like Pharma, Metals, Banking and financials ahead of the budget 2021 which will limit the upsides.

* FII’s lowered there long leverage positions as Nifty made a high of 14750 which will add some more pressure in coming days.

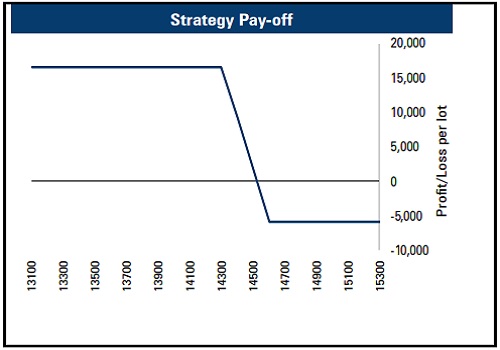

* Hence, we feel index is likely to move towards 14300 levels for the coming week and recommend forming a Reverse Collar strategy due to higher IV’s which will reduce the overall cost in the strategy and give higher returns on downside.

Sell Nifty future 14570-14590 TGT 14300

To Read Complete Report & Disclaimer Click Here

For More ICICI Direct Disclaimer http://icicidirect.com/disclaimer.html

SEBI Registration number is INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Top News

Sectoral View on Consumer Tech Businesses in India: Opportunities and Challenges by Rohit Ch...

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">