Cotton trading range for the day is 22530-23030 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

COTTON

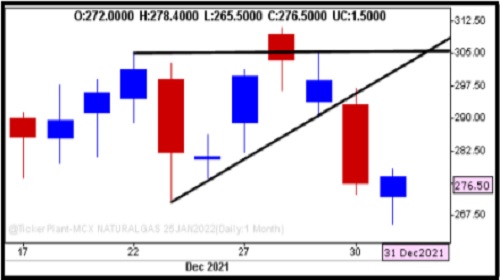

Cotton yesterday settled up by 0.09% at 22790 after CAI has revised higher Indian cotton export estimates for 2020-21 season at 65 lakh bales against 60 lakh bales projected till last month. Cotton production in Haryana is expected to decline by 27 percent to 1.8 million bales in 2020-21 (July-June) season due to yield loss. India’s cotton output in the 2020-21 (October-September) market year is seen at 38 million bales, up 4 percent on the year. The country’s cotton exports are likely to be 20 percent higher at 1.02 million tonnes in 2020-21 (October-September) backed by competitive pricing in the global markets and an improvement in international cotton consumption, said Care Rating. Higher exports along with a recovery in domestic cotton demand will help reduce the surplus availability of cotton in the nation despite higher supply, the rating agency said in a note. Cotton farmers from various states are planning to increase the area under cultivation in the coming 2021-22 Kharif season. Indian textile mills have reduced production due to lower domestic demand and labour shortage. The government has allowed mills to operate but markets are closed so mills are facing a cash crunch. Textiles mills dealing in exports are still going strong as Indian yarn prices are attractive. In spot market, Cotton gained by 40 Rupees to end at 22820 Rupees.Technically market is under fresh buying as market has witnessed gain in open interest by 0.26% to settled at 7065 while prices up 20 rupees, now Cotton is getting support at 22660 and below same could see a test of 22530 levels, and resistance is now likely to be seen at 22910, a move above could see prices testing 23030.

Trading Idea for the day

Cotton trading range for the day is 22530-23030.

Cotton pared gains on profit booking after prices seen supported as CAI has revised higher Indian cotton export estimates at 65 lakh bales

Cotton production in Haryana is expected to decline by 27 percent to 1.8 million bales in 2020-21 (July-June) season due to yield loss.

According to the Punjab Agriculture Department, sowing is been done on only 63,220 hectares, whereas the target is to cover 3.25 lakh hectares area.

Cocudakl

Cocudakl yesterday settled down by -2.47% at 2569 amid worries of lockdown it is anticipated that there will be slow supply and same with demand. However downside limited amid prospects of higher exports and falling supply in the physical market. Cottonseed production and quality were affected last year due to excessive rains in the key producing State of Telangana and some parts of Tamil Nadu. 2021/22 global cottonseed production is projected at nearly 44 million tons, up 5 percent from the current year. Higher forecasts for the United States, Brazil, Australia, and Mali are partially offset by declines in China. U.S. production is forecast up 781,000 tons to nearly 5 million. Waning arrivals of raw cotton due to the fag end of the season and limited stocks of cottonseed with ginners has led to a supply crunch in the market. India has produced around 36 mln bales in the ongoing 2020-21 (Oct-Sep) season, of which nearly 33 mln bales, or 92% of the stock, has already arrived in the market. Considering firm demand outlook for the commodity, the tight supply situation in cottonseed is expected to continue in the coming months as well as the new season for cotton will start only in October. In Akola spot market, Cocudakl dropped by -30.6 Rupees to end at 2720.85 Rupees per 100 kgs.Technically market is under long liquidation as market has witnessed drop in open interest by -0.17% to settled at 101660 while prices down -65 rupees, now Cocudakl is getting support at 2524 and below same could see a test of 2480 levels, and resistance is now likely to be seen at 2623, a move above could see prices testing 2678.

Trading Idea for the day

Cocudakl trading range for the day is 2480-2678.

Cocudakl prices seen under pressure amid worries of lockdown it is anticipated that there will be slow supply and same with demand.

Cottonseed production and quality were affected last year due to excessive rains in the key producing State of Telangana and some parts of Tamil Nadu.

2021/22 global cottonseed production is projected at nearly 44 million tons, up 5 percent from the current year.

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer