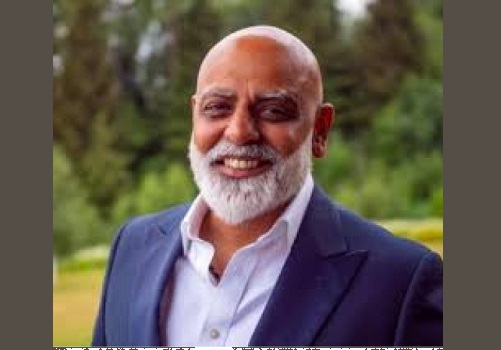

Comment on Rupee Continues to Fall By Mr. Hitesh Jain, YES Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Comment on Rupee 21 July 2022 By Mr. Hitesh Jain, Lead Analyst – Institutional Equities, YES SECURITIES

INR has been under steady depreciation pressure throughout this calendar year, courtesy of monetary policy tightening by the DM economies and the consequent FPI outflows from capital markets. India’s widening trade gap and capital outflows also raised the risks for the rupee. Nevertheless, RBI is aggressively intervening in FX markets to stem the weakness in INR, resorting to sell/buy swaps in the spot and forward market. Moreover, there has been a slew of measures taken by the central bank and the government to boost inflows of Forex and arrest the Rupee fall. In terms of the INR outlook for the rest of this calendar year, we sense that the worst is priced in the currency, with the value likely to be peaking around 80.5-81 against the greenback. We say this because there is a growing indication that inflation across the globe has peaked given the wide retreat in Food prices, Oil and other industrial commodities. Stress in the global supply chain is also reported to have eased, while global aggregate demand is slowing, manifested by a downgrade in global economic forecasts. Consequentially, markets are tapering the expectations on the quantum of Fed rate hikes, which can be characterised by a retracement in US 10yr yields to 2.9% from the peak of 3.4%. The buoyancy in the dollar index seems to be petering out, wherein Euro is now seeing a strong reversal from the parity. On India’s foreign capital portfolio flows as well, July trends show FII outflows from the Equity markets have slowed during the first fortnight, while Indian markets have managed to fetch some gains during the last 30 days, even when pain persists in global equities. Perhaps a change in trend indicates FIIs are having a change of heart for India. All these developments allude to lesser downward pressure on the INR, with the USDINR due for some mean reversion or possibly a consolidation around the 79 mark.

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">