Cancel licences of tax evading insurers: GIEAIA

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

With about goods and services tax (GST) evasion amounting to about Rs 2,250 crore by some players in the general insurance industry, a major union in the sector has urged the government and the regulator to cancel licences of such entities.

"We demand the IRDAI (Insurance Regulatory and Development Authority of India) take a proactive action in this regard," Trilok Singh, General Secretary, General Insurance Employees' All India Association (GIEAIA) told IANS.

"The evasion of GST by some private players is maligning the entire industry. If the private players are not evading the statutory dues, will they pay the policyholders claims promptly is the question that begs an answer," he added.

The IRDAI conspicuously silent on the issue of huge GST evasion by the private general insurance players.

IRDAI officials do inspect the books of accounts of the insurers and yhe question is how did they miss this huge GST evasion.

Simply put, the insurers had paid their intermediaries over and above what they were to pay legally. The amount has been accounted under various heads on which GST falls due.

According to an industry official, if the books of entries are reversed for the insurers and taxes paid, then they may have to bring in fresh capital to meet the solvency norms.

The Working Committee of the GIEAIA at their meeting held in Pune recently has demanded the Centre, the Department of Financial Services, and the IRDAI should take strict prompt action against the tax evaders.

It has demanded the IRDAI/government to impose huge penalties or even cancel their licences for not paying the GST and Income Tax.

The evasion of tax running into thousands of crore of rupees has raised the questions on the integrity of such insurers which are maligning and defaming the whole sector, the GIEAIA said.

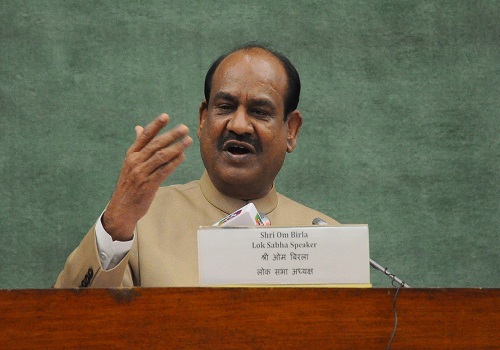

The GIEAIA Working Committee has also urged the government amongst others to refer the proposed amendments to insurance laws to the Parliamentary Committee on Finance for a meaningful and constructive discussion.

Top News

Parliamentary panel asks Renewable Energy Ministry to seek enhancement of priority sector le...

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">