BoJ Modifies YCC: Market impact and assessment Says Ms. Madhavi Arora, Emkay Global Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is BoJ Modifies YCC: Market impact and assessment by Ms. Madhavi Arora, Lead Economist, Emkay Global Financial Services

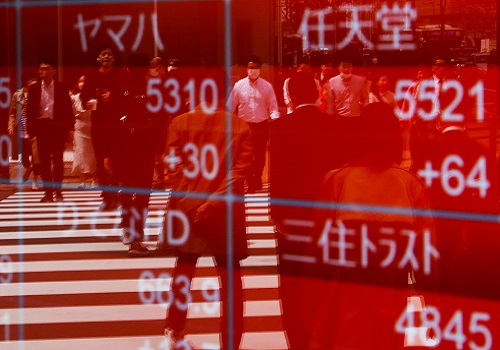

? In today’s BoJ meeting, the policy makers unexpectedly adjusted the 10 yr Yield Curve Control (YCC) band from +/-25bp to +/-50bp. The move now implies an effective rate of +0.5%for all BoJ purchases for 10 yr JGBs. The move was largely expected to happen early next year.

Although the BoJ cited the need to improve market functionality as the main reason for the policy change, the recent trend rise in inflation is indeed the main factor behind rise in market expectations for higher rates (JP Nov core inflation: 2.8% expected).

Governor Kuroda tried to sound dovish in his presser and reiterated they remain on the path of easy policy. The BoJ showed concern over increasing volatility in overseas financial and capital markets, which has significantly affected Japanese markets.

It said the functioning of bond markets has deteriorated, and if such a situation persists, it could have a negative impact on financial conditions. But if a market malfunction is an important reason for today’s move, a further move may follow because just a 25bp move cannot end or improve the malfunctioning.

? We note repricing was happening mildly everywhere across the curve (+OIS), but the 10Yr remained anchored due to YCC (Ex 1).

The BoJ itself justified such a move by saying that it might further sustain monetary easing, but we think today’s actions could be a slight precursor to eventually letting go of YCC & finally increasing deposit rates to zero from current -0.1% under a new governor in H1CY23.

? Today’s surprise move by the BoJ has caused higher volatility in other countries’ bond markets. The UST 10Y yield is already up more than 10bp. The BoJ may create higher volatility in overseas financial and capital markets and the take of BoJ policymakers would be important to keep an eye on.

FX Impact:

As a knee-jerk reaction, JPY rose 2.5% to 3% against the rest of the G10 bloc, and USD/JPY dropped around 4.2 yen (133.17 currently).

While both JGB 10Y and UST 10Y rise, USD/JPY slightly shifted away from the recent correlation with the rates spreads to the downside. But the pair’s 4-yen move looks to be in line with a 25bp shrink of the UST-JGB 10Y yield gap, according to the recent correlation.

Therefore, whether USD/JPY diverges from here or not should be an important point to monitor for the trend in coming days or weeks.

We think JPY may enjoy near-term further appreciation owing to today’s surprise BoJ move for a while, but we are not sure whether only a tweak of YCC will be able to have significant impact to change the course of the weak Yen trend. We reckon the actual fundamental driver of the Yen has been the increasing trade deficit and widening short-term yield gap.

Today’s first move by the BoJ may change market sentiment for the short term. However, with the current short-term yield gap and Japanese importers’ massive JPY sales for imports, keeping a JPY long-position looks very difficult. (Ex 2)

Fixed income impact:

Japan has roughly $9tn of savings invested globally and if the BoJ widening of the 10yr band continues, there could be carry trade reversal and massive repatriation of Japanese savings across the globe (Ex 3).

This could be especially true when Japanese financial institutions would be running losses on JGBs, they might be forced to book profits on their foreign investments.

Plus incrementally, risk adjusted flows of (falling) Japanese savings to fund global risk assets may also be lower going ahead, implying pressure on global fixed income yields to that extent. UST yields were anyways unattractive to Japanese investors before today’s BoJ move. The outflow pressure may now spread to even the Euro & other EM debt.

Above views are of the author and not of the website kindly read disclaimer

.jpg)

Top News

India, UK likely to hold next round of talks on proposed trade agreement in October: Sunil B...

More News

Can COP27 deter Africa from a 'dash for gas' in green energy transition?