Base metals prices traded firm on Wednesday with most of the metals gained in the opening trade - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

GLOBAL MARKET ROUND UP

Commodity prices traded firm on Tuesday with Bullion prices extended gains while base metals witnessed recovery in evening session boosted by weaker dollar. Crude oil prices traded steady in upper range along with development in Iran nuclear talks. The dollar index fell to the lower levels since January losing 0.23% for the day.

US Fed officials, with few exceptions, have offered reassurances that they view near-term inflation pressures as transitory, signaling they would look through a near-term pickup in price pressures as the economy recovers from the coronavirus pandemic.

Asian shares were mixed on Wednesday while the U.S. dollar stood near its lowest levels this year after U.S. Federal Reserve officials reaffirmed a dovish monetary policy stance, providing yet more assurance to investors worried about the inflation outlook.

BULLION

Bullion prices traded higher on Wednesday with spot gold prices at COMEX were trading near $1906 per ounce while spot silver prices at COMEX were trading over half a percent up at $28.15 per ounce in the morning trade. The precious metals edged higher with gold rallied above $1900 giving break out of the psychological resistance level on inflation worries. The dollar index fell to lowest level since January while US 10 year treasury yields fell to 1.55% boosting buying in precious metals. The US FED accepted transitory inflation with supply bottlenecks. The fall in Bitcoin also supported buying in bullion with investors switching to safer assets.

We expect bullion prices to trade up for the day. MCX Gold June resistance for the day lies at Rs. 49200 with support at Rs. 48700. MCX Silver July support lies at Rs. 71200 , resistance at Rs. 74000 per KG.

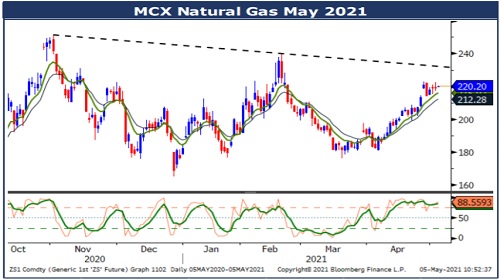

ENERGY

Crude oil prices traded weak with benchmark NYMEX WTI crude oil prices were trading 0.24% down near $65.91 per barrel in the morning trade. Crude oil prices remain fluctuated ahead of weekly inventory data and ongoing Iran nuclear talks. The traders and investors remained vary on mixed fundamentals which has kept oil prices in range. The weaker dollar and broad buying in commodities has supported oil prices while expectation of bullish weekly inventory data may side-line Iranian supply pressure.

We expect crude oil prices to trade sideways to up for the day. MCX Crude Oil June support lies at Rs. 4750 per barrel with resistance at Rs. 4890 per barrel.

BASE METALS

Base metals prices traded firm on Wednesday with most of the metals gained in the opening trade. Base metals prices traded higher supported by weaker dollar and FED comments. The US FED smoothened inflation worries terming it transitory. Copper prices traded higher on supply disruption fears from Chile. Workers at BHP Group’s remote operations center in top copper producer Chile rejected the company’s latest wage offer and will begin a strike on Wednesday.

Base metals are expected to trade sideways to up for the day. MCX Copper June support lies at Rs. 739 and resistance at Rs. 754. MCX Zinc June support lies at Rs. 231, resistance at Rs. 237. MCX Nickel June support lies at Rs. 1240 with resistance at Rs. 1280.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">