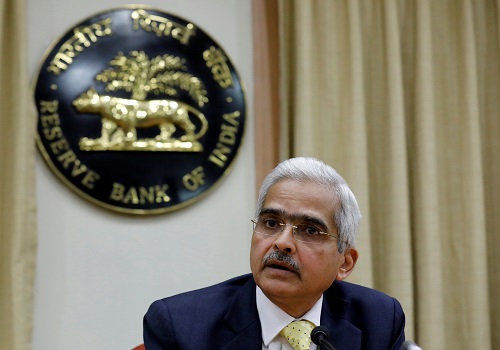

Banks, NBFCs need to strengthen their capital position: Shaktikanta Das

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Reserve Bank of India (RBI) Governor Shaktikanta Das has said that banks and non-banking financial companies (NBFCs) need to strengthen their capital position because there could be stress due to the second wave of COVID-19. He, however, added that in response to the RBI's call and based on their own assessment, private and public sector banks raised capital from the market throughout last year and so their overall capital position is at a very stable level currently. He said 'they are all hitting our regulatory requirements. Some of them are even much higher.'

RBI Governor also said he was confident that the non-performing loans of banks will be within the projections made in its Financial Stability Report (FSR) in January 2021. He noted that the FSR in January had projected the banks' gross non-performing assets (GNPAs) rising to 13.5 percent by September 2021, under a baseline stress scenario. He added that and if the macroeconomic environment worsens to a severe stress scenario, the GNPA ratio may escalate to 14.8 percent.

Asked whether the NPAs would remain within the range indicated in the FSR, Das said ‘our expectation is that whatever projection we have given earlier in the last FSR, it will be within that.’ The next FSR is due at the end of the current month. The RBI on June 4, 2021 left the repo rate unchanged at 4 percent and maintained an accommodative stance to revive and sustain growth on a durable basis.