65% growth in Grade A green office stock across top 7 cities since 2019

With global occupiers seeking green certifications in new Indian office buildings, Grade A office developers are increasingly constructing LEED, IGBC or GRIHA certified stock to stay in sync with the demand. Latest ANAROCK Research data shows a significant 65% jump in overall Grade A green-certified office stock across the top 7 cities since 2019.

Approx. 530 Mn sq. ft. of Grade A office stock in the top 7 cities out of the total Grade A office stock of 865 Mn sq. ft. is green certified as of H1 2025 across cities. Back in 2019, approx. 322 Mn sq. ft. had such certification.

At approx. 163 Mn sq. ft., Bengaluru has the maximum stock of green-certified office stock among these cities in H1 2025 – a 31% share of the total, green-certified inventory in the top 7 cities.

* NCR comes a distant second with approx. 97 Mn sq. ft. or 18% overall green-certified share.

* Hyderabad has approx. 87 Mn sq. ft. green certified Grade A office stock, or a 16% overall share.

* Kolkata has the least green-certified office stock with just approx. 17.4 Mn sq. ft., or 3%.

"City-wise, Bengaluru also accounts for the highest percentage share of green-certified Grade A office stock in the top 7 cities," says Anuj Puri, Chairman - ANAROCK Group. "Of its total Grade A office stock of 223 Mn sq. ft., nearly 73% or approx. 163 Mn sq. ft. in Bengaluru is green-certified. In contrast, MMR - with total Grade A office stock of approx. 144 Mn sq. ft. in H1 2025 - just 67 Mn sq. ft. or 47% as green-certified."

In both NCR and Hyderabad, 62% each of the total Grade A office stock is green-certified. In NCR, out of the total 157 Mn sq. ft. of office stock, approx. 97 Mn sq. ft. is green-certified. In Hyderabad, approx. 87 Mn sq. ft. of a total of 140 Mn sq. ft. Grade A office stock is green-certified.

“The push towards sustainability comes partly from the Government’s own initiatives and commitments, and partly from the demand for such solutions," adds Puri. "There is increasing awareness about the need for sustainability across all real estate segments. However, the demand for sustainable office buildings outstrips that for green housing. A vast number of occupiers, especially MNCs and GCCs, now insist on sustainability features only available in green-certified Grade A office buildings."

In contrast, there has still not been such an imperative-driven shift in the Indian housing segment, and this is visible in the relative scarcity of green residential stock in the country. Commercial real estate is proving to be India's sustainability vanguard.

H1 2025: Rentals Vs Vacancy Levels

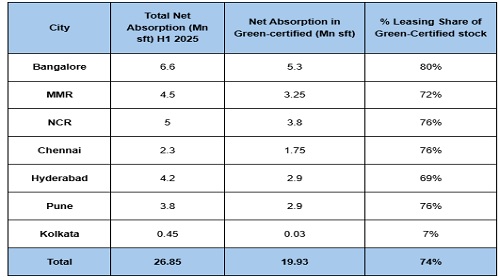

As per ANAROCK data, the top 7 cities saw approx. 26.8 Mn sq. ft. of office space leased in H1 2025, of which over 74% (approx. 19.93 Mn sq. ft.) was in green-certified office buildings. City-wise, Bengaluru led decisively - of the net 6.6 Mn sq. ft. Grade A office stock leased in the city in the first half this year, certified green buildings accounted for a massive 80% - approx. 5.3 Mn sq. ft.

In Pune, Kolkata and Chennai, the percentage share of leasing in the green certified buildings stood at 76% each in H1 2025.

Despite their commanding premium rentals vis-à-vis regular Grade A office stock, green-certified office spaces have seen leasing increase significantly over the last six years. The average monthly rentals of green-certified office spaces in the top 7 cities are up to 24% higher than in regular, non-certified Grade A office stock.

In MMR, the average monthly rent of a Grade A office space is approx. INR 143 per sq. ft., while a green-certified building leases out at approx. INR 177 per sq. ft. (24% higher). In Chennai, the average office rent in green-certified buildings commands a 16% premium over regular Grade A office spaces.

In Kolkata, the monthly green vs. non-green rental gap is narrowest at just 4%. The average monthly rent in a regular Grade A office space is approx. INR 62 per sq. ft. in H1 2025, while green-certified buildings lease out at approx. INR 64.5 per sq. ft.

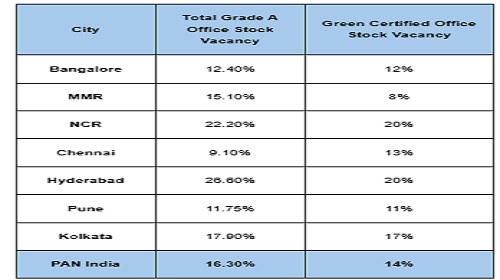

Despite the premium rents, green-certified office spaces have lower vacancies at 14% across the top cities combined, against a 16.30% vacancy rate in non-green certified buildings. In MMR, the vacancy in green-certified office buildings is just 8%, in contrast to the 15.10% vacancy in non-green Grade A stock.

Chennai is the only city where vacancy levels in green-certified buildings (13%) is higher than in regular Grade A office stock (9.10%).

“The surging popularity of green office buildings across India is not merely a passing trend, but a strategic imperative in line with the nation’s bold climate ambitions,” says Puri. “India has committed to achieving net-zero emissions by 2070, and to expand its non-fossil energy capacity to 500GW by 2030. Green office buildings are a major link in this equation. As India grapples with escalating urban pollution and environmental pressures, both developers and businesses must take responsibility for championing sustainable choices in the built environment.”

Moreover, with multinational corporations increasingly insisting on certified eco-friendly workspaces as a key criterion for their operations, prioritizing green buildings is crucial for India to remain globally competitive and attract high-value international occupiers. By increasingly embracing sustainable office infrastructure, India advances both its environmental commitments and its standing as a destination for responsible global business.

Above views are of the author and not of the website kindly read disclaimer