Renewable Energy : 1QFY26 preview: Sequential pickup; steady margins by Kotak Institutional Equities

FY2025 has been a record year for solar capacity additions (23.8 GW); however, solar manufacturing capacity has kept pace with demand (91 GW of ALMM modules and 27 GW of solar cells give us confidence that the industry is on track to reach supply-demand parity by the latter part of FY2027). The US module demand outlook remains uncertain given multiple changes in regulations. For 1QFY26, we expect strong marginal sequential revenue growth and stable margins, driven by (1) continued solar capacity additions, (2) higher utilization of Waaree’s cell facility, (3) commissioning of Premier’s module facility and (4) stable module and cell pricing.

Solar capacity additions robust; cell capacities on the rise

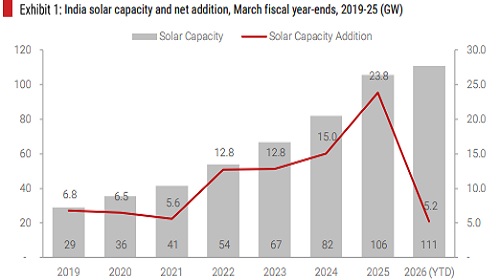

FY2025 saw record solar capacity addition of 23.8 GW (+60% yoy growth); similar momentum has continued in FY2026 with total solar capacity addition of 5 GW in two months (30 GW annualized). While demand remains robust, manufacturing capacity has kept pace with solar capacity additions, as ALMM module capacity has now reached 91 GW, more than 2X of DC demand. Further, domestic cell capacity has increased to 27 GW (including First Solar’ thin-film module), giving us confidence that the industry is on track to reach supply-demand parity for solar cells by the latter part of FY2027, in line with our estimates.

US module export a short-term play, cell exports hold potential

Uncertainty surrounding the future of tax credits on solar power installation and probable removal of incentives for residential solar (10% of market) are likely to reduce solar addition from 50 GWdc levels. With demand slowing down and domestic module capacity crossing 50 GW, we expect US module imports to see a significant decline in the next couple of years. However, since the US still severely lags in cell capacity, along with imposition of anti-dumping duty on SEA countries, there is an opportunity for Indian manufacturers to tap the market.

1QFY26 preview: Marginal sequential revenue uptick with steady margins

We expect a strong 1QFY26 for our solar manufacturing coverage, driven by (1) continued solar capacity additions, (2) production scale-up of Waaree’s 5.4 GW cell facility, (3) commissioning of Premier’s new 1.6 GW module facility, (4) higher utilization and (5) stable pricing. For Waaree, we expect 32% yoy/12% qoq revenue growth and 470 bps yoy margin improvement, driven by contribution from cell facility, improved utilization and strong growth in EPC business. For Premier, we expect 11% yoy growth in revenues, driven by higher capacity utilization and modest contribution of the newly inaugurated module facility.

Changes in estimates

Waaree: We revise our EPS estimates by 1-7% for FY2026-28E, baking in betterthan-expected profitability due to higher share of cell and retail segments. We increase our FV to Rs2,620 (Rs2,600 earlier) and retain SELL rating. Premier: We revise our FY2026E EPS by 10.4%, factoring in higher realization in the DCR market. Our FV remains unchanged at Rs900 and we retain SELL rating

Domestic solar market has seen a strong start in 1QFY26

India’s solar capacity addition has seen a strong start in 1QFY26 (5.2 GW capacity addition during the first two months). This is on the back of 60% yoy surge to 23.8 GW in FY2025 compared to 15 GW in FY2024—nearly four times solar capacity added in FY2021. With the country’s current installed solar capacity at 111 GW as of May 2025 and the government targeting 500 GW of renewable energy, including approximately 300 GW from solar, we expect annual additions to accelerate to 35-40 GW over the next 5-6 years.

The bulk of FY2025 capacity additions came from ground mounted solar (16.6 GW) and solar rooftop (5.2 GW) cumulatively accounted for ~90% of total addition.

The DCR (domestic content requirement) market, which primarily comprises PM Surya Ghar Yojna, and PM KUSUM scheme also saw a healthy addition of 7 GW over the period. In the first two months, India added 1.4 GW In rooftop solar and 0.3 GW in PM KUSUM. Annualizing said data indicates DCR market to see ~10 GW of demand in FY2026. Looking ahead, we expect the DCR market to be nearly 10-12 GW, of which 8-9 GW will come from the PM Surya Ghar and KUSUM while the rest will be from CPSU scheme

India’s annual solar capacity addition has quadrupled from ~6 GW to ~24 GW in past five years; India has already added 5.2 GW for the year (~30 GW annualized)

Above views are of the author and not of the website kindly read disclaimer