20% allocation in gold ETF a better investment strategy: Quantum AMC

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

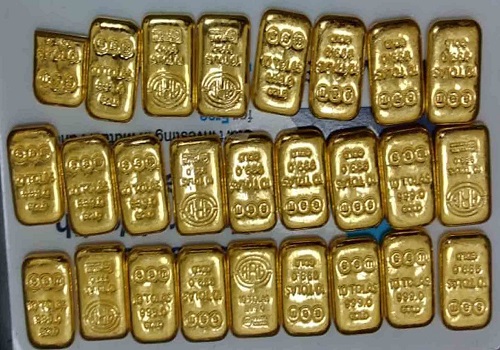

At a time when there are many risks and uncertainties in the global economy, a 20 per cent allocation to gold ETFs in an investment portfolio during Diwali is ideal, said Quantum AMC.

In a statement issued on Monday, Quantum AMC said the correction in the gold prices from the peak has made the metal affordable this festive season.

"To make the most of the correction, we recommend investing in efficient products such as gold ETFs (exchange traded funds) to maximize the benefits," Quantum AMC said.

Owning physical gold comes with additional costs such as making charges, retail premiums, storage concerns, and lower buyback value.

On the other hand, gold ETFs are highly liquid, incur no making charges, and ensure exposure to insured pure gold.

Also, the buy-sell spreads are tight making ETFs price efficient.

The rise in the US interest rates and the likelihood of the hawkish stance of the Federal Reserve converting itself into rate hikes which may go well into the next year as well may keep gold prices at the lower end of the range, Emkay Global Financial Services said in a recent report.

"The current spell of gold weakness may continue till there is more concrete information on the state of the economy in the major economies, especially against the background of an aggressive central bank trade-off unfavourable to growth and promoting stability," Emkay Global remarked.

Generally, gold is considered as a hedge against inflation but this time around it does not seem so.