EcoCapsule November 2025: Indian Festivals Lighten Up Global Doom by SBI Capital Markets

Executive Summary

A thaw in trade relations between US and China is promising for global growth

The global economy has shown remarkable resilience, with growth in CY25, though middling, projected to be not much worse than in CY24. Glut in traditional sectors has been offset by demand for AI and data centres. However, there are some early indicators that tariffs and the incessant bickering around them may be creating cracks. Jobs cuts reached a two-decade high in the US in Oct’25, while the same month saw Chinese exports falling for the first time since ‘Liberation Day’. However, the US-China agreement which has reduced tariffs on China below 50% (with more cuts likely to come) and eased the flow of rare earths, may just be the booster shot which stops the descent into slowdown. In this mood of continued uncertainty compounded by the shutdown hiding crucial data, the US Fed remains a divided camp on the rate trajectory, adding another element of unpredictability for policymakers worldwide.

Commodity prices see volatility and sharp variance between individual goods

Prices of energy commodities remain soft on uneven demand and supply increases of crude. On the other hand, base metals are seeing consistent rises in costs owing to supply side curbs from China. Precious metals have risen sharply, with gold seeing almost a 50% y/y price gain. This rapid rise at a time when crude prices have remained soft is unprecedented. It indicates a role for gold as an asset class beyond inflation hedging in the new economic order – exemplified by Central Banks eschewing the USD to stock up on the yellow metal. Given most Central Banks are on a rate cut trajectory, any shocks from inflation could upset the apple-cart.

Festive fervour boosts consumption activity in India as the country emerges from monsoon dampness

Consumption based indicators showed buoyancy in Oct’25 on the back of multiple festivals and GST rate rationalisation. Vehicle retails grew by a whopping 41% y/y on Oct’25. UPI transactions hit a record of 2.7 mn during the month, with Diwali sales rising a whopping 25% y/y to over Rs. 6 trn as per CAIT. With PMI indicators maintaining their sanguinity and continued spending push from the government in terms of capex and revex, the softness seen due to heavy monsoons in Q2 seems to have made way for a sunny Q3. We continue to expect nominal GDP growth at ~8.5% y/y, with real GDP supported by an low deflator and consumption pickup

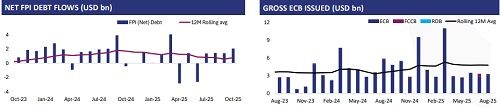

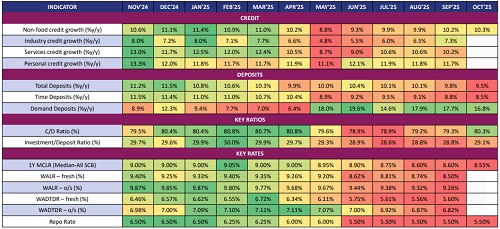

Bank credit revives on retail impetus in select segments even as the economy awaits corporate capex with bated breath

Credit-deposit ratio has crossed 80% once again. We expect that fresh term deposit rates have bottomed out in near term, and this is coinciding with renewed drivers of credit growth. Stocking before the festive season supported a spike in MSME credit in Sep’25, and record vehicle sales and huge consumption expenditure on consumer durables will aid in supporting growth Oct’25 onwards. The spike in gold prices is also providing impetus for gold loans by enhancing borrowing ability. With the outlook for the rate trajectory remaining benign and hope of private large corporate capex still alive, we expect a sustainable pickup in credit growth in the medium term, with bank credit growth clocking 1.3-1.5x of nominal GDP growth in FY26

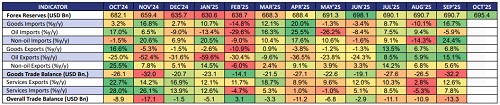

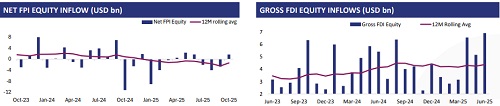

External sector in a flux as RBI opens multiple fronts to guard the INR though CAD to remain in control

After the INR dropped to historical lows, the RBI opened its dollar purse, and has taken strong measures to defend the rupee. Outstanding net forward position remained exacerbated as of Aug’25 and the RBI sold USD 7.7 bn for this effect. FII flows have recovered in Oct’25 providing some succour, and the impact of hot money flows on the exchange rate will remain a monitorable. Moreover, trade deficit remains prey to change in India’s crude basket and expected bump up in gold imports during the festive period. The silver lining is that despite these challenges, CAD, at ~1% of nominal GDP in FY26, is expected to be well within historical levels. Along with a USD 700 bn forex reserve, it presents a fortress to guard against global swings.

MACROECONOMIC OVERVIEW

GROWTH IN H2 COULD BE CUSHIONED BY CONSUMPTION BOOST

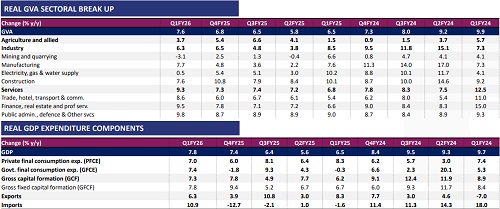

REAL GVA SECTORAL BREAK UP

* Real GDP growth outpaced market estimates, with domestic anchors like strong consumption and robust capital formation driving domestic it. This was despite crosswinds from muted trade and global tariff turmoil. Notably, manufacturing took the reigns of industrial growth, with services, led by financials, outshining other sectors

* Nominal GDP will remain challenged in FY26 as inflation sinks, and we expect an 8.5% y/y figure to register

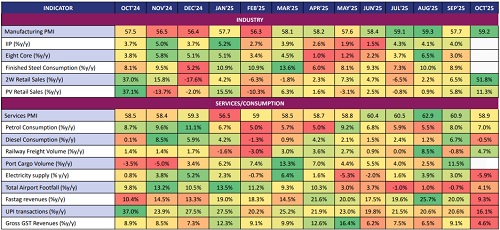

FESTIVE FIREWORKS BRIGHTEN DOMESTIC INDICATORS

GST RATIONALISATION BASED DEMAND PROPS UP ALL SECTORS

Festive crackers sparked by GST rate rationalisation aiding consumption demand

* Auto retail sales rose 40.5% y/y to all time highs, as GST rate cuts spurred affordability and first-time buying. 2W surged 52% y/y to 3.1 mn units in Oct’25, supported by rural demand and festive rush leading to stronger footfalls and conversions. PV sales hit all-time highs in Oct’25 while 18% y/y expansion in CVs aided freight movements.

* Festive season fervour was evident in strong rise in petrol consumption in Oct’25. Resurgence in airport footfalls and ATF consumption further corroborate on festive season travels

* UPI rose 16% y/y to all time highs of Rs. 27.3 bn in value terms in Oct’25. CAIT reckons that festive purchases crossed Rs. 6 trn, up 25% y/y

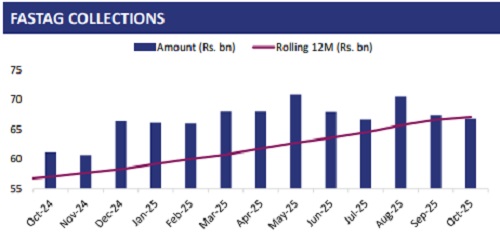

* FasTag collections rose 9% y/y despite introduction of annual passes that shaved off 43.3 mn trips

Manufacturing sings along with consumption despite unseasonal showers

* Manufacturing PMI expanded sharply to 59.2 in Oct’25, with faster increase in new orders underpinning buoyant demand due to GST relief and productivity gains. Strong demand led to producers raising output prices at 12-year high pace, while slowing input price inflation means expansion of margins

* IIP maintained its pace in Sep’25, driven by resurgent manufacturing growth. Sharpest upticks were noted in infrastructure goods and there was a revival in consumer durables, indicative of demand for discretionary goods. Cement and steel continue to drive Core sector growth, while energy-based sectors contracted on moderate demand

* Unseasonal downpours post Sep’25 led to rainfall exceeding normal by ~44% (as of 6 Nov’25), leading to average maximum temperatures falling by over ~1° C across the country in Oct’25. Consequently, power demand fell 6% y/y due to limited use of cooling equipment. NR had particularly low consumption as higher minimum temperatures reduced heating load

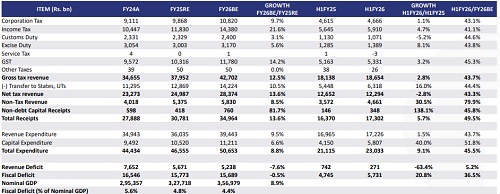

UNION FISCAL SITUTATION IN CONTROL DESPITE MODERATION IN TAX RECEIPTS

* Net direct tax revenue growth eased to 6.3% y/y, reaching Rs. 11.9 trn as of YTDFY26 (as on 12 Oct’25). This was despite a decline in refunds as gross collections rose sluggishly. Growth remains below run rate required to achieve FY26BE

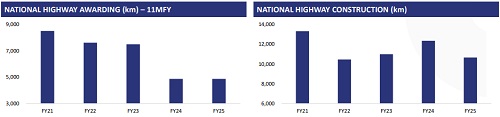

* 9% y/y rise in total expenditure was led by 40% rise in capex in H1FY26, with rising pace of spends on roads and defence

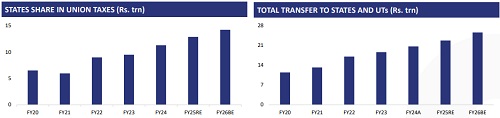

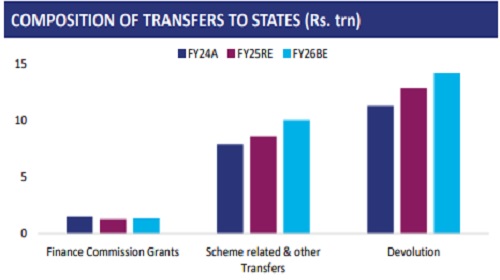

STATES RECEIVE EXTRA DEVOLUTION FROM THE UNION

* Union released an additional tax devolution of Rs. 1.01 trn to State governments. This is in addition to normal monthly devolution due to be released on 10 Oct’25. UP received the highest allocation at Rs. 182 bn, followed by Bihar at Rs. 102 bn

* As per media sources, the Union is planning a new scheme to revitalise DISCOMs, in which the options involve either privatising or listing DISCOMS. Six states – UP, MP, Maharashtra, TN, AP, and Rajasthan have apparently agreed to privatisation

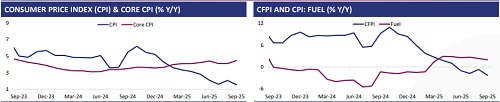

SHARPLY RECEDING FOOD PRICES HOLD BACK INFLATION IN SEP’25

* CPI fell to a 99-month low in Sep’25, dragged by sharp disinflation in food prices, despite broad-based uptick. Notably, core rose to its highest in 2 years, with rising metal prices

* WPI dipped to 0.1% y/y in Sep’25 largely due to falling food and manufactured goods prices. Inflation in fuel and power was deflationary, despite input price volatility, while that in manufactured products eased, supported by textile and food products

THE DEPRECIATION OF THE RUPEE: RBI RISES IN FULL ARMOUR

IMPROVED SENTIMENT GETS FOREIGN INVESTORS TO DOMESTIC SHORES

* FPIs reversed their 3-month withdrawal streak from domestic equities, driven by participation in big-ticket IPOs and select sectoral bets.

* Debt segment witnessed modest growth in inflows driven by flows into FAR securities, while outflows through VRR route is reflective of investor caution on duration risks

SECTORAL UPDATES

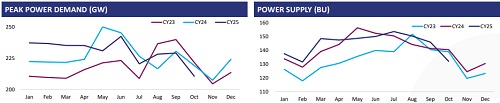

POWER DEMAND TANKS ON COOL WEATHER, DRAGS DOWN EXCHANGE PRICES

* Power consumption fell 6% y/y in Oct’25, with unseasonal monsoon dampening demand for cooling appliances. Notably, the fall was steeper for Northern and Western regions where rainfall was ample and temperatures were conducive

* DAM prices fell 32% y/y to Rs. 2.67/unit in Oct’25 with ample hydro generation boosting supply side liquidity. Prices recovered in early Nov’25 to above Rs. 3/unit

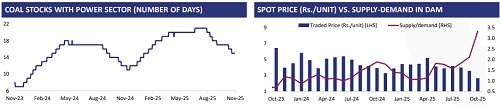

HIGHWAY FASTAG ROUND-UP SHOWS IMPACT OF ANNUAL PASS

* FasTag collections pace slowed to 9.3% y/y in Oct’25, a seasonal low, with 43.3 mn trips via annual passes denting collections

* Union is mulling sweeping reforms in PPP highway projects including extending VGF cap beyond 40% through annuity payments, ensuring 95% land acquisition before constructions, usage of sustainable materials, etc.

* To mitigate project delays and cost overruns, MoRTH has introduced tighter financial eligibility criteria for HAM and EPC contractors.

CREDIT GROWTH ON REDEMPTION PATH

Above views are of the author and not of the website kindly read disclaimer