The FOMC policy-makers kept the benchmark rate unchanged at 0.25% By Heena Naik, Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Below are Views On The FOMC policy-makers kept the benchmark rate unchanged at 0.25% By Heena Naik, Research Analyst - Currency, Angel Broking Ltd

*FOMC Monetary Policy Outcome*

* On 22nd Sep '21, the FOMC policy-makers kept the benchmark rate unchanged at 0.25% as per market expectations but were divided over the hike. They are now expecting a lift from either 2022 or 2023 versus the previous support for 2023 for a rate hike.

* It’s worth noting that the US central bank cut the 2021 growth forecast and remained unclear on when the rate will start rising after the tapering concludes.

* The dot plot provided the first hint of hawkishness with 9 members favoring a 2022 rate hike, up from 7. The PCE forecasts, which are measures of inflation, were also revised sharply higher for 2021, 2022 and 2023.

* Fed Chair hinted at the positive conditions matching for the consolidation of the asset purchase and also signaled that a tapering process that concludes around the middle of next year is likely to be appropriate.

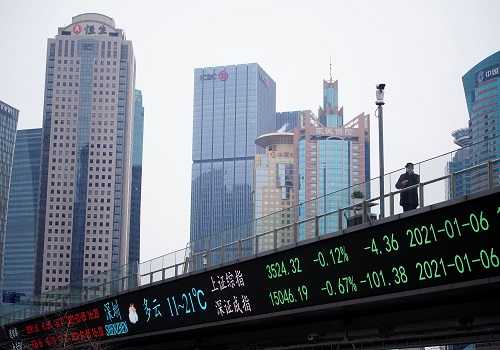

* The US Dollar Index hit its highest in a month after the policy release where the stage was set for rate hikes next year — far sooner than its developed market peers are expected to move.

* USDINR is likely to move higher where 74.00 remains a major psychological level break of which could push it towards 74.20 and higher levels. EURINR and GBPINR shall also move Higher due to same.

Above views are of the author and not of the website kindly read disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One