GST cuts for several Covid-relief items; no change in vax tax

The GST Council on Saturday decided to slash rates of several Covid-relief items to 5 per cent from existing 12 to 18 per cent levels but kept the much anticipated tax rate on vaccines unchanged at 5 per cent.

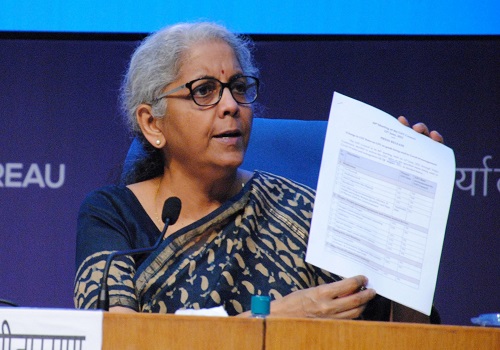

Addressing the media, post the GST Council meet, Finance Minister Nirmala Sitharaman said that the council agreed to go with the recommendations of the Group of Ministers (GoM) that was single point agenda on the council on Saturday.

She said that while rate of tax on various Covid relief medical items has been reduced, no change had been made in the 5 per cent GST rate on vaccines but it would not impact the public as vaccination is being provided for free.

She said that the Centre will be paying and receiving 75 per cent of all the tax collected on it that will be further distributed with states. She had earlier said that exempting vaccines from GST would deny input tax credit on raw material and supplies that could impact its pricing.

As part of Covid relief measures, the 44th meeting of the GST Council reduced GST rate on Remdesivir to 5 per cent from 12 per cent and that of medical grade oxygen to 5 per cent.

The council has also reduced the rates on the medicines used for black fungus (Mycormucosis) and brought it to nil level.

The special duty cuts would be applicable till September 30, 2021.

Sitharaman said that though the GoM recommended the rate cuts till August, the council decided to keep it till September end and later decide if further extension were required.

In another major move, the GST rate on ambulances has been reduced to 12 per cent from the previous 28 per cent.